Post by : Soumya Jit

When it comes to financial security and wealth building, two traditional investment options have stood the test of time — Real Estate and Gold. Both have been trusted by generations, offering different kinds of benefits. While real estate is a tangible, income-generating asset, gold has always been a safe-haven investment, especially in uncertain times.

But the year 2025 brings new economic realities, market fluctuations, and technological advancements that are changing how investors view these assets. So, the big question is: Which is the better investment in 2025 — Real Estate or Gold?

Let’s dive deep into the advantages, risks, and future prospects of both.

Real estate has always been associated with long-term growth and stability. Unlike gold, it’s not just about holding value — it can generate steady income through rentals and provide opportunities for capital appreciation.

Here’s why real estate in 2025 continues to attract investors:

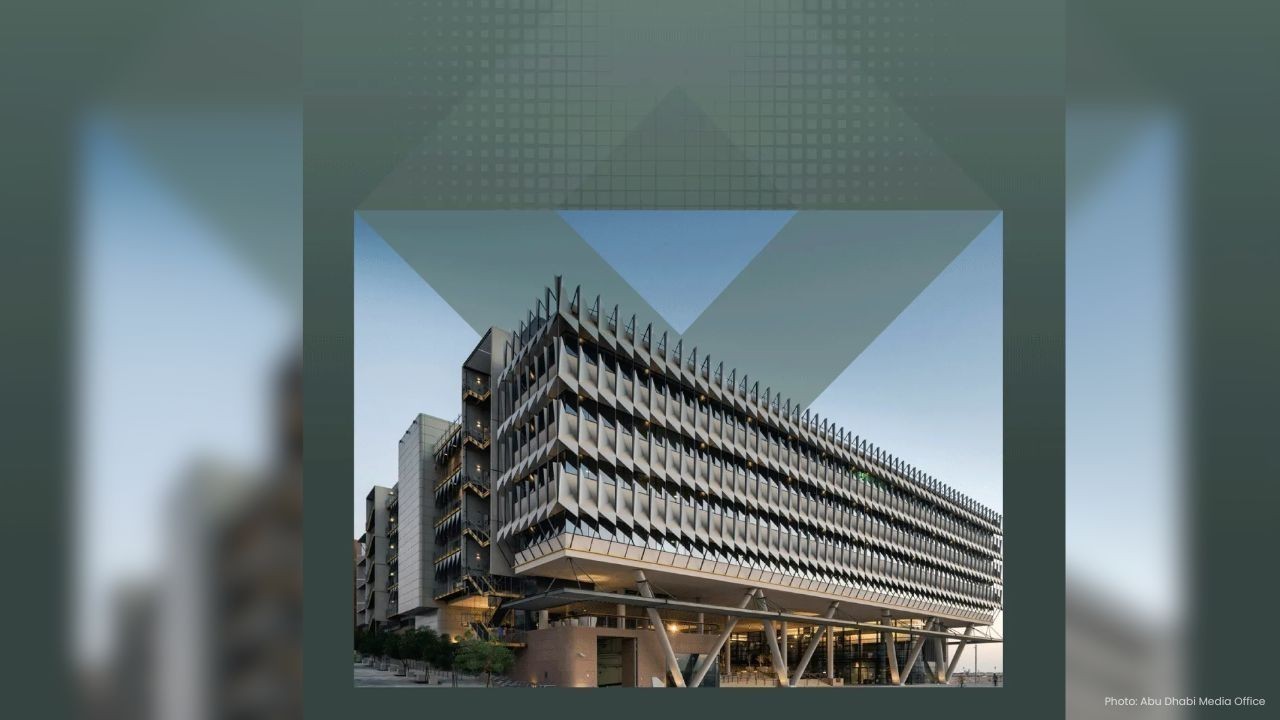

With urbanization increasing globally, cities are witnessing higher demand for affordable housing, luxury apartments, and commercial spaces. In countries like India, UAE, USA, and parts of Europe, real estate is seeing steady growth due to population expansion and the rise of smart cities.

Unlike gold, real estate generates monthly income through rent. For many investors, this is a major advantage because it provides passive income alongside capital growth.

In 2025, many cities are recording 8–12% annual appreciation in property value. Real estate investments, especially in prime locations, often outperform inflation and create generational wealth.

Adding real estate to an investment portfolio reduces risks from volatile assets like stocks. It provides a tangible, stable foundation.

The rise of proptech (property technology), AI in real estate management, and digital property transactions is making real estate more transparent and accessible than ever before.

Drawback: Real estate, however, requires higher initial investment, comes with maintenance costs, property taxes, and has lower liquidity compared to gold.

Gold has been considered the ultimate safe-haven asset for centuries. In uncertain times — wars, recessions, inflation — investors turn to gold for security and stability.

In 2025, gold is still highly relevant, and here’s why:

When the cost of living rises, gold retains its purchasing power. In times of inflation, real estate prices may fluctuate depending on demand, but gold almost always preserves value.

Gold is one of the most liquid assets. It can be sold almost instantly anywhere in the world, unlike real estate, which may take months to liquidate.

Gold is a globally recognized asset. Whether in Dubai, New York, or Tokyo, it holds value. This makes it a safe choice for investors who travel or want a globally secure investment.

Unlike real estate, gold does not require repairs, taxes, or upkeep. Once purchased, it can be stored easily in banks, vaults, or even digital gold wallets.

Drawback: Gold does not generate regular income. Unlike real estate rentals, it just sits until sold. Also, its value can fluctuate with global economic conditions and currency markets.

Let’s compare both in terms of returns, risks, liquidity, and long-term potential.

Returns on Investment (ROI):

Real Estate: 8–12% annually in growing cities.

Gold: 5–7% annually, mainly inflation-adjusted.

Liquidity:

Real Estate: Low – takes time to sell.

Gold: High – can be sold instantly.

Risk Factor:

Real Estate: Risks depend on location, regulations, and market conditions.

Gold: Risks come from global price fluctuations.

Passive Income:

Real Estate: Generates monthly rental income.

Gold: No income, only appreciation.

Wealth Building:

Real Estate: Best for long-term wealth creation.

Gold: Best for wealth preservation.

If your goal is to grow wealth and pass it on to the next generation, real estate is better. It not only appreciates but also generates consistent rental income.

If you want quick liquidity and safety, gold is the right choice. You can easily sell it and protect yourself against economic downturns.

The smartest approach in 2025 is diversification. Having both real estate and gold creates a balance between growth and security.

Real Estate in 2025:

Growing demand in urban areas.

Strong appreciation in emerging markets.

Increased foreign investments in cities like Dubai, London, and Singapore.

Rise of smart homes and green real estate projects.

Gold in 2025:

Prices are expected to remain stable due to global economic uncertainties.

Central banks worldwide continue to hold gold as a reserve asset.

Growing trend of digital gold investments among younger investors.

Both real estate and gold continue to be excellent investments in 2025, but they serve different purposes:

Real Estate: Best for long-term wealth creation, passive income, and capital appreciation.

Gold: Best for liquidity, safety, and inflation protection.

The smartest investors in 2025 are not choosing one over the other — they are investing in both to build a diverse and resilient portfolio.

In 2025, the debate of Real Estate vs Gold isn’t about which one is better overall — it’s about which one is better for you based on your financial goals. If you want cash flow and long-term appreciation, go for real estate. If you want security and liquidity, choose gold. And if you want the best of both worlds, combine them to ensure your financial stability and growth.

Fire on Mumbai-Valsad train engine, all passengers safe

A fire broke out in the Mumbai Central-Valsad train engine at Palghar. All passengers are safe. Rest

Sharjah Ruler Launches Raad Al Kurdi Quran Recitation

Sheikh Sultan launches Raad Al Kurdi’s Quran recitation at Sharjah Academy, honoring efforts to spre

Real Estate vs Gold: Best Investment Options in 2025 for Wealth & Security

Real Estate or Gold in 2025? Discover which investment is better for wealth creation, passive income

Sharjah Ruler Honours Emirates Islamic Bank Team

Sheikh Sultan honours Emirates Islamic Bank for supporting Quran Academy projects in Sharjah, boosti

Abu Dhabi Customs records strong digital growth in 2025

Abu Dhabi Customs sees over 10% rise in digital deals, faster clearances, and record customer satisf

UAE & Azerbaijan Join Hands to Boost Investment & Growth

ADQ and Azerbaijan Investment Holding unite to grow key sectors, trade ties, and regional projects,

Bangladesh Bars Sheikh Hasina & Family From Voting 2026

Ex-PM Sheikh Hasina and her family cannot vote in Bangladesh’s Feb 2026 elections as NIDs are blocke

The Mind Gut Connection How Your Diet Shapes Your Mood and Mental Health

Discover how your diet affects mental health mood and stress Learn tips to keep your gut and mind

Dubai s 2025 Property Outlook Key Trends Prices and Investment Opportunities

Discover Dubai s 2025 property trends price changes rental yields and investment opportunities in

Like Trees Let Us Live to Give A Lesson in Purposeful Living

Discover life lessons from trees on giving purpose and serving others in every season inspiring a

From Street Style to High Fashion How Modest Fashion is Evolving in the UAE

Explore how modest fashion in the UAE evolved from traditional wear to stylish street and high fashi

Spotlight on Emerging Emirati Designers Shaping Dubai s Global Fashion Scene

Discover how emerging Emirati designers blend tradition modernity and sustainability to redefine D

Mastering Power Dressing Your Complete Guide to Dubai s Business Style

Learn how to master power dressing in Dubai s business world with tips on colors fit accessories

The Rise of Sustainable Fashion in the UAE Eco Friendly Trends Shaping 2025

Explore how sustainable fashion is transforming the UAE with eco friendly trends innovative designs

The Hottest Fashion Trends of 2025 Bold Colors Sustainable Styles & Dubai Street Fashion

Explore 2025 fashion trends in Dubai bold colors sustainable styles oversized outfits vintage lo