Post by : Anish

The UAE’s financial markets have entered the final quarter of 2025 on a strong footing, boosted by stable oil prices, rising tourism, and increased foreign investments. The Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX) have both witnessed sustained growth through the year, outperforming several regional peers. Backed by favorable economic reforms, rising corporate profits, and strategic diversification initiatives, investors are keeping a close watch on UAE equities for Q4.

Market analysts predict that several sectors are primed for accelerated growth in the coming months, driven by robust domestic demand, global market trends, and government policy support.

Energy remains the backbone of the UAE economy, and in Q4 2025, it continues to offer resilience amid global market fluctuations. With Brent Crude hovering around $85 per barrel and OPEC+ maintaining output discipline, UAE-listed energy companies are projected to deliver stable returns.

Top Trends in the Energy Sector:

Adnoc Gas and Adnoc Distribution continue to attract investor interest due to strong dividends and profitability.

Renewable energy subsidiaries under Adnoc and Masdar are gaining traction as the UAE targets net-zero goals.

High global demand from Asia and Africa keeps oil and gas exports robust.

For investors seeking stability and steady returns, energy stocks remain a reliable component of their portfolios.

The UAE’s banking sector has shown remarkable performance in 2025, with several banks reporting record quarterly profits. Higher interest rates have contributed to improved net interest margins, while diversified income streams have reduced sectoral risks.

Key Highlights:

Emirates NBD, First Abu Dhabi Bank (FAB), and Dubai Islamic Bank are reporting double-digit profit growth.

Increased digital banking adoption is enhancing efficiency and cost savings.

Regional expansion, particularly into Egypt and Saudi Arabia, is fueling future growth prospects.

Stable loan growth and strong retail banking demand boost sector performance.

Banking stocks are considered favorable for both income-focused and growth-oriented investors in Q4.

Tourism remains a vital sector for Dubai and the wider UAE economy. Expo City Dubai and new attractions launched during the year are driving consistent tourist inflows.

Sector Drivers:

Hotel operators like Emaar Hospitality and Aldar Properties’ tourism segments are seeing high occupancy rates.

Retail-focused REITs are benefiting from rising consumer spending linked to tourism.

The aviation recovery, with Emirates and Etihad posting improved passenger numbers, supports tourism-linked investments.

With the holiday season approaching, tourism-linked stocks and REITs are expected to see further gains.

The UAE’s ambitious vision to become a global tech hub by 2030 is already reflecting in market dynamics. ADX’s tech-focused segments have seen new listings, while Dubai is actively promoting artificial intelligence (AI) and fintech initiatives.

Growth Opportunities in Tech:

Recent IPO listings like Presight AI have generated significant investor buzz.

Government support through Dubai Future District Fund enhances funding for tech ventures.

AI integration in sectors like banking, healthcare, and logistics is creating cross-sector investment opportunities.

Tech remains one of the highest potential sectors for long-term capital appreciation.

With the UAE hosting COP28 in 2023 and maintaining strong climate commitments in 2025, sustainable investing is gaining mainstream traction.

Green Investment Themes in Q4:

Masdar’s renewable energy projects continue to receive investor confidence.

Green bonds and ESG-focused ETFs listed in ADX are seeing rising subscriptions.

Focus on hydrogen energy and sustainable urban projects strengthens future outlook.

Investors aiming for eco-conscious portfolios are increasingly adding green stocks and bonds to their holdings.

Dubai’s real estate market remains healthy, though price growth has moderated compared to previous years. However, certain sub-segments and locations are outperforming.

Real Estate Trends to Watch:

Luxury apartments in Downtown Dubai and Palm Jumeirah continue to command premium valuations.

Aldar Properties in Abu Dhabi is witnessing strong demand in mixed-use developments.

Industrial and logistics REITs are benefitting from e-commerce growth and Dubai’s trade hub status.

Real estate-linked stocks and REITs offer selective opportunities, especially in premium residential and industrial segments.

While the overall outlook remains positive, analysts caution about potential risks including:

Global geopolitical tensions affecting oil prices.

US Federal Reserve monetary policy shifts impacting interest rate-sensitive sectors.

Volatility in global tech markets potentially influencing UAE tech stocks.

Fluctuations in global tourism patterns.

Diversified portfolios focusing on fundamentally strong UAE sectors are recommended to mitigate risks.

Market experts remain optimistic about UAE equities in Q4 2025, with energy, banking, and tech offering top returns, supported by tourism and green sectors. Retail investors, institutional funds, and foreign investors are all showing sustained interest in UAE-listed companies, boosting liquidity and market depth.

However, a balanced approach—combining growth sectors with defensive plays like banking and utilities—is advised to navigate potential global headwinds.

This article is for informational purposes only. Stock market investments involve risks. Please consult a certified financial advisor before making any investment decisions.

Fire on Mumbai-Valsad train engine, all passengers safe

A fire broke out in the Mumbai Central-Valsad train engine at Palghar. All passengers are safe. Rest

Sharjah Ruler Launches Raad Al Kurdi Quran Recitation

Sheikh Sultan launches Raad Al Kurdi’s Quran recitation at Sharjah Academy, honoring efforts to spre

Sharjah Ruler Honours Emirates Islamic Bank Team

Sheikh Sultan honours Emirates Islamic Bank for supporting Quran Academy projects in Sharjah, boosti

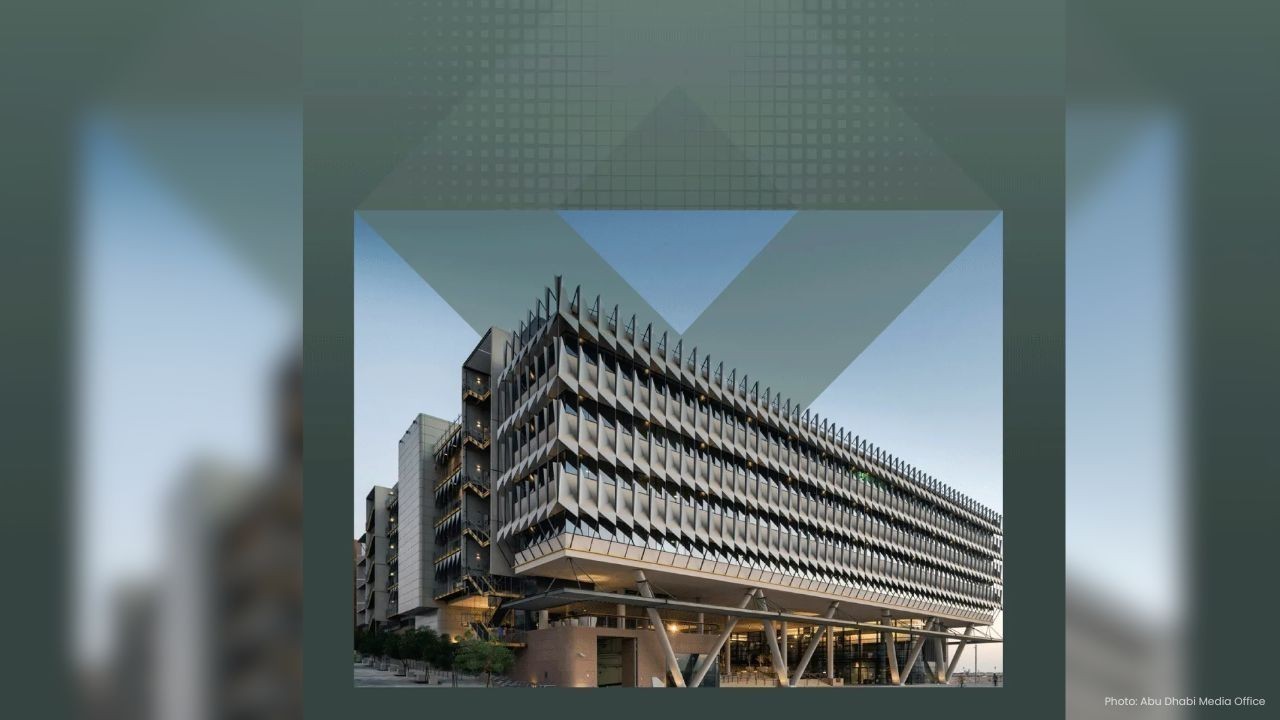

Abu Dhabi Customs records strong digital growth in 2025

Abu Dhabi Customs sees over 10% rise in digital deals, faster clearances, and record customer satisf

UAE & Azerbaijan Join Hands to Boost Investment & Growth

ADQ and Azerbaijan Investment Holding unite to grow key sectors, trade ties, and regional projects,

Bangladesh Bars Sheikh Hasina & Family From Voting 2026

Ex-PM Sheikh Hasina and her family cannot vote in Bangladesh’s Feb 2026 elections as NIDs are blocke

Avatar Fire and Ash 2025 Pandora s New Epic Adventure

Discover Avatar Fire and Ash 2025 a thrilling new Pandora adventure with stunning visuals new tri

The Mind Gut Connection How Your Diet Shapes Your Mood and Mental Health

Discover how your diet affects mental health mood and stress Learn tips to keep your gut and mind

Dubai s 2025 Property Outlook Key Trends Prices and Investment Opportunities

Discover Dubai s 2025 property trends price changes rental yields and investment opportunities in

Like Trees Let Us Live to Give A Lesson in Purposeful Living

Discover life lessons from trees on giving purpose and serving others in every season inspiring a

From Street Style to High Fashion How Modest Fashion is Evolving in the UAE

Explore how modest fashion in the UAE evolved from traditional wear to stylish street and high fashi

Spotlight on Emerging Emirati Designers Shaping Dubai s Global Fashion Scene

Discover how emerging Emirati designers blend tradition modernity and sustainability to redefine D

Mastering Power Dressing Your Complete Guide to Dubai s Business Style

Learn how to master power dressing in Dubai s business world with tips on colors fit accessories

The Rise of Sustainable Fashion in the UAE Eco Friendly Trends Shaping 2025

Explore how sustainable fashion is transforming the UAE with eco friendly trends innovative designs

The Hottest Fashion Trends of 2025 Bold Colors Sustainable Styles & Dubai Street Fashion

Explore 2025 fashion trends in Dubai bold colors sustainable styles oversized outfits vintage lo