Post by : Sam Jeet Rahman

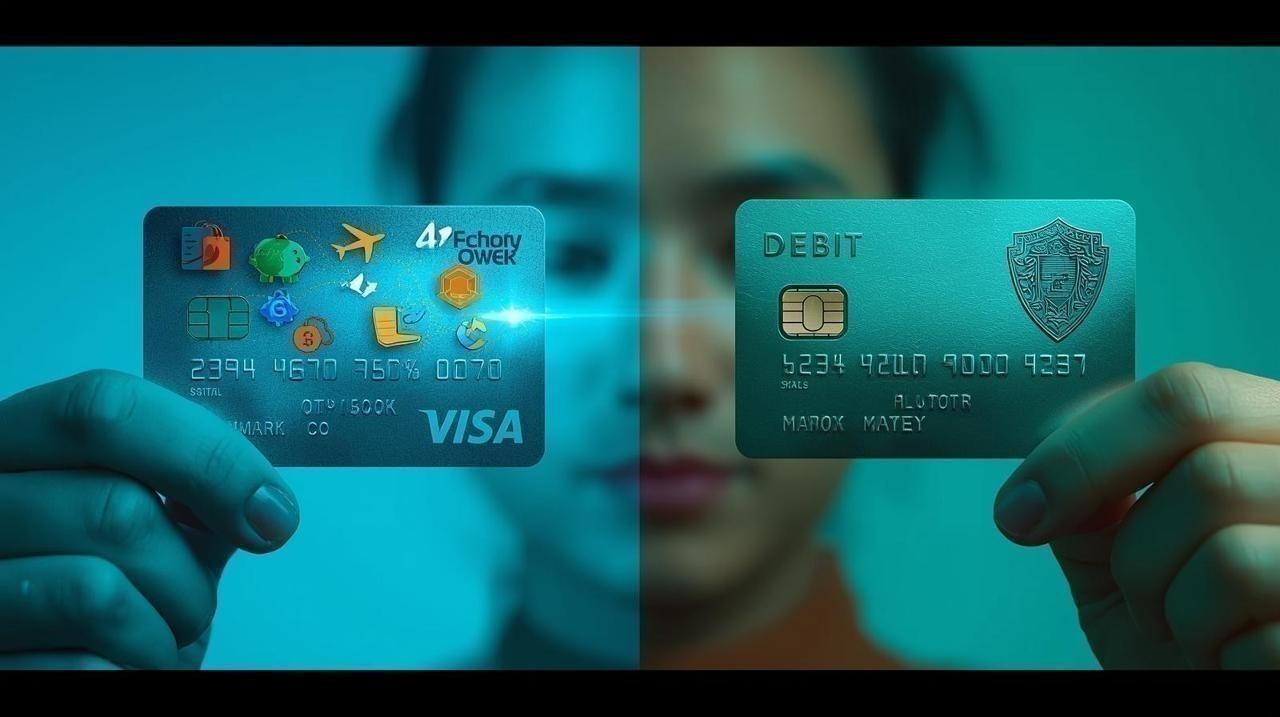

When it comes to everyday spending, the question often arises: should you rely on a credit card or stick with a debit card? Both look similar, swipe the same way, and are widely accepted around the world, but they function very differently. Choosing between the two can affect your financial health, spending habits, and even your long-term credit score.

This article explores the pros and cons of both payment options, examines how they impact your money management, and helps you decide which one works best for your lifestyle.

A debit card is directly linked to your bank account. When you spend, the money is immediately withdrawn from your balance. You can only use what you already have.

A credit card, on the other hand, allows you to borrow money from the bank or card issuer up to a certain limit. You pay it back later, ideally before the due date to avoid interest charges. Essentially, one uses your money instantly, while the other lets you use the bank’s money temporarily.

With a debit card, you can only spend what’s in your account. This makes it easier to stick to a budget and avoid unnecessary debt.

Since you’re not borrowing money, you don’t pay interest. What you spend is simply deducted from your account balance.

For groceries, small bills, and daily expenses, debit cards are quick, safe, and straightforward.

Debit cards naturally limit overspending because you can’t spend more than what you own.

Using a debit card doesn’t build your credit history. If your goal is to improve your credit score, debit won’t help.

Unlike credit cards, debit cards don’t usually offer cashback, travel points, or purchase protection benefits.

While banks do offer fraud protection, it’s usually stronger with credit cards. If money is stolen from your debit card, it directly affects your bank balance until the issue is resolved.

Every time you pay your bill on time, it positively affects your credit history. A strong score is essential for getting loans, mortgages, or even rental approvals.

Credit cards often come with perks such as cashback offers, airline miles, discounts on shopping, and insurance coverage for travel or purchases.

If you don’t have enough cash on hand, a credit card can cover urgent expenses until payday.

Most credit card companies offer robust protection against fraudulent transactions, meaning you’re less likely to lose money permanently.

If you don’t pay your bill in full, interest rates—often between 15% to 25% annually—can pile up quickly, leading to debt traps.

Since you’re not using your own money immediately, it’s easy to overspend and rack up debt.

Missing a payment can result in hefty late fees and a negative mark on your credit score.

If you prefer simplicity and want to avoid debt, debit cards are the safest choice for everyday expenses. They help you stick to your budget without risking high-interest debt.

But if you’re disciplined with money and pay off your balances regularly, credit cards can be more rewarding. The perks, cashback, and credit-building benefits outweigh the risks—as long as you manage them responsibly.

Daily expenses like groceries, fuel, and small bills

If you’re prone to overspending and want tighter control

When you want to avoid any possibility of paying interest

Large purchases where you want added protections

Online shopping and travel bookings, where fraud risks are higher

Building and maintaining a strong credit score

Earning cashback, rewards, or discounts

Always track your spending, regardless of the card type.

Set payment reminders to avoid late fees on credit cards.

Don’t store sensitive card details on unsecured websites.

Review your monthly statements for any unauthorized charges.

Both credit cards and debit cards serve important roles in personal finance. Debit cards give you control and prevent debt, while credit cards provide rewards, protection, and credit-building benefits. The key is not to choose one over the other blindly but to use them strategically based on your financial goals and spending habits.

Used wisely, both can complement each other—your debit card keeps your daily budget in check, while your credit card builds your future financial credibility.

Credit cards generally offer stronger fraud protection, making them safer for online shopping and travel.

No. Only credit cards report to credit bureaus and help build your score.

Not if you’re disciplined. As long as you pay the full balance each month, using a credit card daily can earn rewards without leading to debt.

You may face late fees, higher interest, and a negative mark on your credit score.

Yes. Using both smartly allows you to enjoy rewards and credit benefits from your credit card while keeping spending control with your debit card.

Winter Skin Care: 10 Hydrating Drinks That Give Natural Glass Skin Glow

Learn how simple winter drinks keep your skin hydrated reduce dryness and support a natural glass sk

10 Songs That Carry the Same Grit and Realness as Banda Kaam Ka by Chaar Diwari

From underground hip hop to introspective rap here are ten songs that carry the same gritty realisti

PPG and JAFZA Launch Major Tree-Planting Drive for Sustainability

PPG teams up with JAFZA to plant 500 native trees, enhancing green spaces, biodiversity, and air qua

Dubai Welcomes Russia’s Largest Plastic Surgery Team

Russia’s largest plastic surgery team launches a new hub at Fayy Health, bringing world-class aesthe

The Art of Negotiation

Negotiation is more than deal making. It is a life skill that shapes business success leadership dec

Hong Kong Dragon Boat Challenge 2026 Makes Global Debut in Dubai

Dubai successfully hosted the world’s first Hong Kong dragon boat races of 2026, blending sport, cul

Ghanem Launches Regulated Fractional Property Ownership in KSA

Ghanem introduces regulated fractional real estate ownership in Saudi Arabia under REGA Sandbox, ena

Winter Skin Care: 10 Hydrating Drinks That Give Natural Glass Skin Glow

Learn how simple winter drinks keep your skin hydrated reduce dryness and support a natural glass sk

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin