Post by : Michael Darzi

The banking world is changing faster than ever before, and the main reason behind this shift is Artificial Intelligence (AI). Banks, once known for long queues, piles of paperwork, and endless waiting, are now becoming digital hubs. Today, banking is about speed, convenience, and smarter decisions. From helping banks manage risks better to offering virtual advisors that guide customers, AI is transforming how banks work and how people use their services.

Let’s take a closer look at how AI is reshaping banking, why it matters, and what it means for everyday people.

Risk is a big part of banking. Every loan, investment, or transfer has a chance of going wrong. In the past, banks used slow and traditional methods to check risks. But now, AI has made it faster and smarter.

Monitoring in Real Time: AI can watch transactions as they happen. If a customer suddenly withdraws a large amount or makes a transaction from an unusual place, AI alerts the bank instantly.

Better Loan Decisions: AI looks at more than just credit scores. It checks spending habits, utility payments, and small digital transactions to get a better idea of a person’s ability to repay. This helps banks approve loans for more people, even those with little credit history.

Stopping Fraud Quickly: Fraud used to be discovered days or weeks later. AI now spots unusual activity in seconds, helping banks stop scams before they cause harm.

By improving risk management, AI keeps banks safer and builds trust between banks and customers.

Customer service is another area where AI has made a big difference. In the past, people had to wait in long lines or call help centers and wait for answers. Now, AI-powered virtual advisors can help customers any time of day.

24/7 Service: These virtual assistants answer questions about account balances, transactions, and loan applications anytime, even at night.

Talking Like Humans: Using advanced technology, AI advisors can understand what customers say and respond naturally, making it feel like talking to a real person.

More Than Questions: Some AI advisors can suggest ways to save money, recommend investment options, or remind customers to pay bills on time.

AI helps customers quickly get the help they need while allowing human staff to focus on more complicated banking tasks.

Banking used to be the same for everyone. AI is changing this by customizing services for each customer.

Tailored Offers: If a person travels a lot, AI may suggest a credit card with travel benefits. If someone saves regularly, AI can recommend investment options to grow their money.

Smart Budgeting: AI apps look at daily spending and send warnings if someone is overspending. They also give tips to save money, making budgeting simpler.

Financial Health Reports: Customers can get reports about their money habits in real time, which was once only available to wealthy clients.

With AI, every customer feels like a priority, and banking becomes easier and more personal.

Digital banking comes with new risks, including hacking and online fraud. AI has become the main shield for banks.

Spotting Unusual Activity: AI can instantly detect transactions that don’t match normal patterns, like using a card in two different countries within a short time.

Biometric Security: Banks are using AI for facial recognition, fingerprints, and voice verification, making it harder for hackers to access accounts.

Learning from Threats: AI systems improve with every attempt to break security, staying ahead of new fraud methods.

These systems make digital banking safe and reliable for customers.

Some people worry that AI will replace human bankers. The truth is more balanced.

Routine Work: AI handles repetitive tasks like filling forms, entering data, and answering simple questions.

Humans Focus on Important Work: Bank employees now handle complex work, such as financial planning, strategy, and building relationships with clients.

Ethical Decisions: Humans are needed to ensure AI decisions are fair and follow banking rules.

This combination of humans and AI creates a stronger, smarter banking system.

AI is still growing, and the next decade could bring even bigger changes:

Highly Personalized Banking: Services that match each customer’s needs and habits.

AI-Run Branches: Branches where most processes, like opening accounts or approving loans, are handled digitally without paperwork.

Predictive Wealth Management: AI tools that help people plan for the future, such as saving for education, retirement, or buying a house.

Financial Inclusion: AI can bring banking services to people in remote areas who currently have little or no access.

The future of banking is about speed, safety, and convenience for all.

AI in banking is not just technology—it is about making life easier and safer. For customers, it means faster services, safer transactions, and smarter advice. For banks, it brings better efficiency, growth, and trust.

From big companies handling billions to students opening their first accounts, AI is reshaping how people manage money. The banking revolution is here, and it is making financial services faster, safer, and smarter for everyone.

This article is published by DXB News Network for informational purposes only. The content is unique and created exclusively for our readers. It should not be reproduced without permission. Financial decisions should always be made after consulting professional advisors.

Seven Arrested in India After Police Solve $800,000 Bank Heist

Police arrest seven suspects after cracking $800,000 bank heist in India. Most stolen cash recovered

Actress Adah Sharma Grandmother Passed Away

Adah Sharma’s beloved grandmother passed away in Mumbai. Fans and the entertainment world send heart

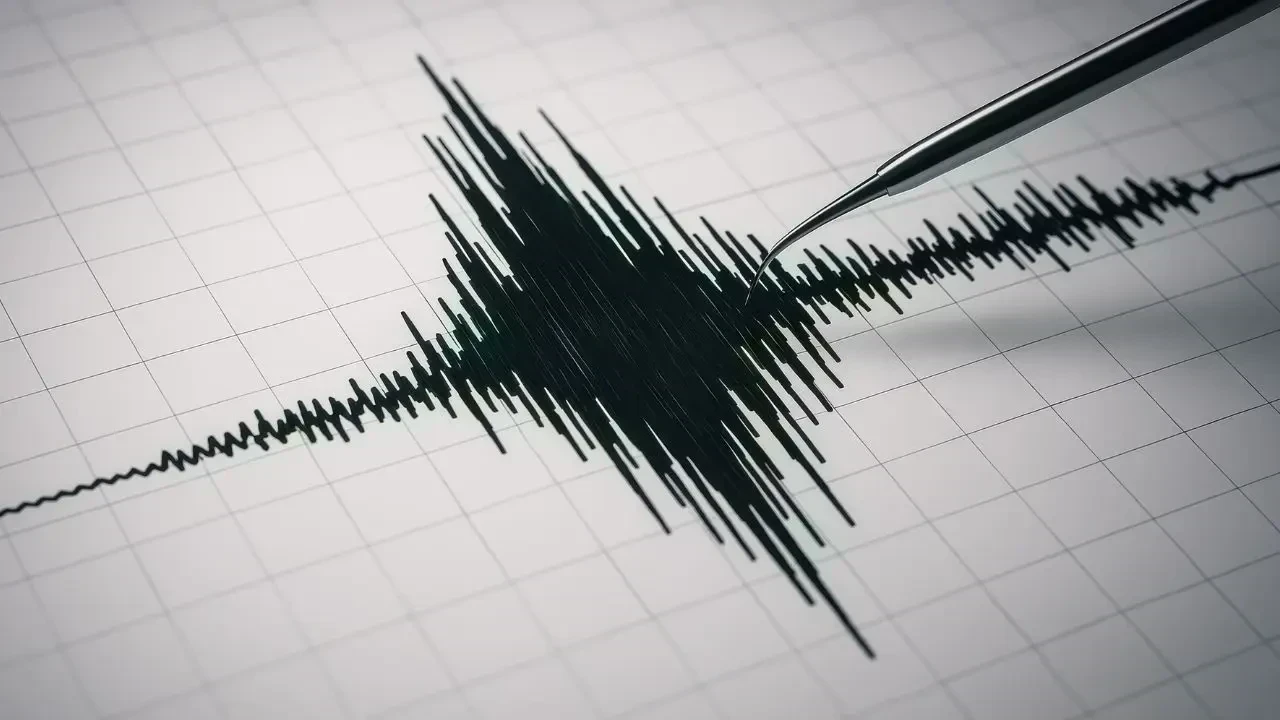

Earthquake of Magnitude 3.9 Hits Bhutan

A 3.9 magnitude earthquake struck Bhutan recently Learn about the quake, risks in the Himalayan regi

X launches “About This Account” feature to spot fake profiles easily

X’s new feature shows account age, location, and username changes to help users find real profiles a

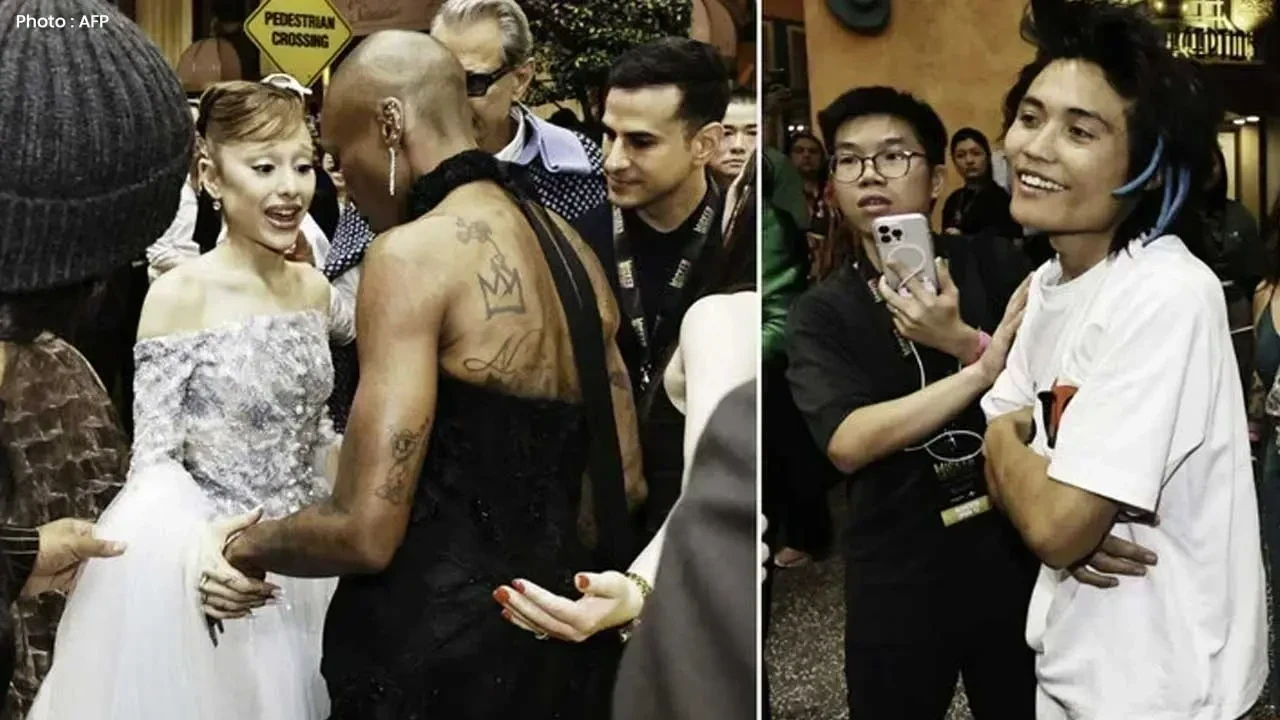

Australian Man Deported After Rushing Ariana Grande at Singapore Premiere

An Australian man jailed for rushing Ariana Grande at Singapore’s "Wicked" premiere was deported and

International Airlines Cancel Venezuela Flights After US Warns of Danger

Several airlines cancel flights to Venezuela after the US issues a safety warning due to rising mili

Six Dead, 16 Injured in Two Serious Road Accidents in Andhra Pradesh

Two separate road crashes in Andhra Pradesh leave six dead and sixteen injured, involving pilgrims a

Taijul Islam Becomes Bangladesh’s Top Test Wicket-Taker

Taijul Islam became Bangladesh’s leading Test wicket-taker with 248 wickets, surpassing Shakib Al Ha

Bavuma Becomes Second-Fastest SA Captain to 1,000 Test Runs

South Africa skipper Temba Bavuma reaches 1,000 Test runs in 20 innings, second-fastest after Graeme

Indian Shuttler Lakshya Sen Beats Chou Tien Chen in Semifinal

Lakshya Sen beats world No. 6 Chou Tien Chen in a thrilling 3-game semifinal to reach Australian Ope

Manuel Arias Banned by FIFA Weeks Before 2026 World Cup

FIFA bans Panama football president Manuel Arias for six months and fines him for not respecting a p

France to Face Brazil and Colombia in World Cup Friendly Games

France will play friendly matches against Brazil and Colombia in March 2026 in the US, ahead of the

Australia Win First Ashes Test with Travis Head’s Century

Travis Head scores 123 to guide Australia to an eight-wicket win over England in Ashes opener. Head

Australia Crush England in First Ashes Test at Perth Stadium

Australia stunned England in the first Ashes Test with Head's century and Starc and Boland taking ke

Sydney Sixers Beat Hobart Hurricanes to End Their Winning Streak

Sydney Sixers defeated the unbeaten Hobart Hurricanes by 11 runs, powered by Ash Gardner’s brilliant