Post by : Soumya Jit

A high-interest market occurs when mortgage rates are elevated, making home loans more expensive. For first-time buyers, this can feel overwhelming, as monthly payments increase, reducing overall affordability.

Interest rates usually rise due to inflation, central bank policies, or economic conditions. Even a 1–2% increase in mortgage rates can significantly impact your monthly payments and the total cost of your home. Understanding how interest rates affect your finances is the first step to making an informed purchase.

First-time buyers face unique challenges:

Higher monthly payments: Elevated interest rates increase loan costs, reducing purchasing power.

Budget constraints: Buyers may need to adjust expectations for location, size, or amenities.

Limited inventory and competition: High-demand areas often lead to bidding wars, which can further inflate costs.

Financial stress: Without careful planning, high rates can strain personal finances and long-term goals.

However, with proper planning and strategic decision-making, first-time buyers can still navigate the market successfully.

Before you start house hunting, evaluate your current financial health:

Income and savings: Ensure you have enough for down payment, closing costs, and emergency funds.

Existing debts: High debt-to-income ratios can reduce mortgage approval chances.

Credit score: A higher score can help secure better interest rates.

Monthly budget: Know what you can realistically afford without overstretching finances.

Being honest about your finances can help you set realistic expectations and prevent mistakes in a high-interest environment.

Interest rates directly affect:

Monthly payments: Even a small difference in rate can add hundreds to monthly costs.

Total loan cost: Over a 30-year mortgage, higher rates can increase the total repayment by thousands.

Home affordability: Higher rates can limit the price range of homes you can afford.

Use online mortgage calculators to estimate monthly payments at various interest rates. This helps in setting a practical budget and identifying homes within your reach.

Choosing the right mortgage type is critical:

Fixed-rate mortgage: Offers stable, predictable monthly payments, making it ideal for long-term planning.

Adjustable-rate mortgage (ARM): Starts with a lower rate that adjusts periodically, which may save money initially but carries risk if rates rise.

Government programs for first-time buyers: Look for schemes that reduce down payment requirements or offer lower rates.

Understanding your options ensures that you select a mortgage that aligns with your budget and long-term goals.

A larger down payment can help mitigate the impact of high interest rates:

Reduces the loan amount, lowering monthly payments.

May qualify you for better interest rates.

Demonstrates financial stability to lenders.

Even an extra 5–10% can significantly reduce the total cost over the life of the mortgage. Consider automated savings plans or short-term investments to boost your down payment.

Interest rates vary between lenders, banks, and credit unions. Don’t settle for the first offer:

Compare mortgage rates, fees, and loan terms.

Check for special first-time buyer programs.

Evaluate the overall cost, not just the monthly payment, including closing costs and insurance.

Even a 0.5% difference in interest rate can save thousands over the life of a mortgage.

When rates are high, focusing on essential features is key:

Location: Proximity to work, schools, and amenities matters most for long-term value.

Affordability: Stick to homes within your budget range, even if it means compromising on size or upgrades.

Resale value: Consider future appreciation and neighborhood growth potential.

Being flexible with non-essential features helps you stay within budget while still purchasing a home you love.

Even in a high-interest market, negotiation can save money and reduce stress:

Seller concessions: Ask for help with closing costs or repairs.

Price negotiations: Don’t be afraid to offer less than the asking price if justified.

Real estate agents: Hire one with experience in high-interest markets to guide you strategically.

Smart negotiation can offset higher mortgage payments and make your home purchase more affordable.

Buying a home in a high-interest market doesn’t end with the mortgage:

Avoid additional debt: Large loans or credit card balances can strain finances.

Maintain an emergency fund: Be prepared for unexpected repairs, property taxes, and insurance costs.

Plan for adjustable rates: If using an ARM, anticipate possible increases in monthly payments.

Insurance: Homeowners insurance is essential for financial security.

These steps ensure you can comfortably manage your home long-term.

Get pre-approved: Shows sellers you’re a serious buyer and speeds up the process.

Keep credit score healthy: Avoid large purchases before closing, as it can affect your loan approval.

Consider future interest rate trends: Even if rates are high now, locking in a rate may still be beneficial if you expect them to rise further.

Home inspection: Never skip this step to avoid costly repairs in the future.

While high-interest rates are challenging, they’re not permanent. Consider:

Refinancing later: When rates drop, you may refinance to a lower monthly payment.

Investing in property value: Focus on homes with growth potential to maximize long-term returns.

Budgeting for the future: High rates teach financial discipline and encourage smart spending habits.

Buying your first home in a high-interest market may feel intimidating, but with careful planning, budgeting, and smart strategies, it is entirely achievable.

Focus on:

Understanding how interest rates affect your mortgage

Saving for a larger down payment

Choosing the right mortgage type

Prioritizing location and essentials

Negotiating wisely and protecting finances post-purchase

By approaching the market strategically and informed, first-time buyers can navigate high-interest environments successfully, securing a home that fits both their budget and lifestyle.

1. How do high-interest rates affect my monthly mortgage payments?

Higher rates increase monthly payments and total loan cost, making homes less affordable.

2. Should I wait for interest rates to drop before buying?

Not necessarily. Rates can be unpredictable, and waiting may delay your homeownership goals.

3. How much down payment is ideal in a high-interest market?

A larger down payment (15–20% or more) reduces loan size, lowers interest costs, and improves affordability.

4. What mortgage type is best for first-time buyers?

Fixed-rate mortgages provide predictable payments, while ARMs may save money initially but carry risk if rates rise.

5. Can negotiation help offset high interest rates?

Yes. Seller concessions, repairs, or price reductions can reduce upfront costs and ease financial strain.

6. How can I improve my chances of loan approval?

Maintain a good credit score, low debt-to-income ratio, and stable employment history before applying.

7. Should I consider refinancing later?

Yes. If interest rates drop in the future, refinancing can lower monthly payments and save money over the life of the loan.

UE Dubai Students Shine at COP30 Simulation in Cairo, Showcasing Global Leadership in Climate Policy

University of Europe for Applied Sciences Dubai (UE Dubai) have taken centre stage at the COP30

Sheikh Hazza Visits Al Shamsi Family, Strengthens Community Ties

His Highness Sheikh Hazza bin Zayed Al Nahyan visits Al Shamsi in Al Ain, engaging with locals and r

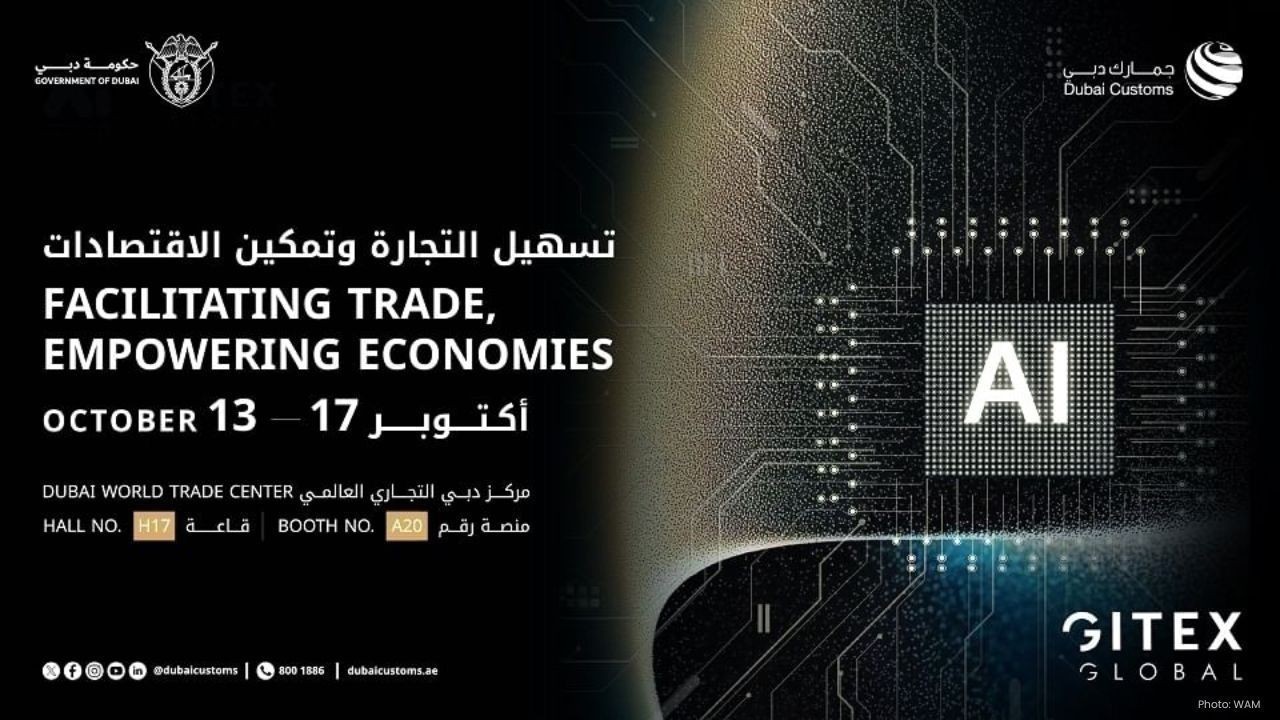

Dubai’s PCFC Showcases Smart Tech at GITEX Global 2025

PCFC highlights AI, smart logistics, and digital platforms at GITEX Global 2025, strengthening Dubai

Ghanadah 60ft Dhow Race Set to Sail in Abu Dhabi on October 10

Over 90 dhows will race 25 nautical miles for AED 4.2 million in Abu Dhabi's Ghanadah 60ft Dhow Sail

Emirates Islamic Lists World’s First Sustainability Sukuk

Emirates Islamic lists USD 500M sustainability-linked Sukuk, a global first, boosting Nasdaq Dubai’s

UAE Central Bank Hosts Global Data Leaders Conference

CBUAE hosts global data experts to explore AI, data innovation, and governance, strengthening centra

World Octopus Day: Red Sea Reveals Rare Marine Treasures

Discover the Red Sea's unique octopus species this World Octopus Day, highlighting Saudi Arabia’s ri

UE Dubai Students Shine at COP30 Simulation in Cairo, Showcasing Global Leadership in Climate Policy

University of Europe for Applied Sciences Dubai (UE Dubai) have taken centre stage at the COP30

Signs Your Gut Health May Be Slowing Your Weight Loss

Poor digestion can slow weight loss Learn the key signs your gut may be affecting metabolism and how

Keto Friendly Fruits Top 10 Low Carb Fruits for Weight Loss Success

Discover 10 keto friendly low carb fruits that support weight loss boost energy and keep your die

Rajvir Jawanda Life Career Music Hits & Tragic Accident Explained

Discover Rajvir Jawanda s journey from police aspirant to Punjabi music star his hits acting career

Karwa Chauth 2025 Date Rituals Legends and Modern Celebrations

Discover Karwa Chauth 2025 date rituals legends and modern celebrations highlighting love devotion a

DGHS Enforces No Cough Syrup Rule for Infants Urges Caution for Kids Under Five

DGHS bans cough syrup for infants and urges caution for kids under five to prevent health risks and

From Flying Taxis to Autonomous Delivery Dubai s Smart Transport Revolution

Explore Dubai s smart transport future with flying taxis autonomous vehicles and delivery drones sha

Are You Confusing Social Anxiety with Shyness Learn the Key Differences

Learn how to tell social anxiety from shyness recognize symptoms and get tips to manage anxiety for