Post by : Sam Jeet Rahman

Disclaimer: This article is for informational and educational purposes only and does not constitute financial, tax, or legal advice. For an accurate valuation tailored to your situation, consult a certified accountant, business valuator, or financial adviser.

Understanding your business’s net worth is one of the single most important financial tasks you can do. It tells you how much equity the business actually holds, helps you make decisions about selling, borrowing, or investing, and is essential for tax planning and exit strategies. This guide walks you through simple accounting net worth, then shows how professionals adjust and value a business for a truer market-oriented net worth.

Business Net Worth = Total Assets − Total Liabilities

That’s the accounting baseline. But a practical, market-ready net worth often requires several adjustments: revaluing assets to market value, normalizing owner’s pay, adding intangible value (goodwill), and considering earn-out or discounting for risk.

You’ll need:

Most recent balance sheet (assets & liabilities)

Last 2–3 years of income statements

Recent cash flow statements

Loan documents, leases, and tax returns

Inventory listings and fixed asset registers

Having clean, up-to-date records makes everything easier and more credible.

Use the balance sheet.

Example (numbers chosen for clarity):

Cash: 120,000

Accounts receivable: 80,000

Inventory (book): 60,000

Prepaid expenses: 5,000

Fixed assets (net book value): 300,000

Total Assets (step-by-step):

120,000 + 80,000 = 200,000

200,000 + 60,000 = 260,000

260,000 + 5,000 = 265,000

265,000 + 300,000 = 565,000

Total Assets = 565,000

Liabilities example:

Short-term loans / credit lines: 40,000

Accounts payable: 30,000

Accrued expenses: 10,000

Long-term loan: 150,000

Total Liabilities:

40,000 + 30,000 = 70,000

70,000 + 10,000 = 80,000

80,000 + 150,000 = 230,000

Total Liabilities = 230,000

Accounting Net Worth = 565,000 − 230,000 = 335,000

This book equity is the starting point: it shows owners’ equity on the books.

Book values can understate (or overstate) true worth. Common adjustments:

Revalue property to current fair market price.

Inventory: write down obsolete stock; mark up high-quality slow-moving goods accordingly.

Receivables: deduct doubtful debts (allowance for bad debts).

Fixed assets: consider replacement cost or market resale value, not just net book value.

Continuing the example:

Fixed assets (book) = 300,000. Market appraisal suggests replacement/resale value = 380,000 → add +80,000.

Inventory book = 60,000. On inspection, 5,000 is obsolete → subtract −5,000.

Receivables book = 80,000. Doubtful portion = 8,000 → subtract −8,000.

Adjusted Total Assets:

Start from previous Total Assets 565,000:

565,000 + 80,000 = 645,000

645,000 − 5,000 = 640,000

640,000 − 8,000 = 632,000

Adjusted Total Assets = 632,000

Make sure you include:

Off-balance-sheet debts (guarantees, contingent liabilities).

Unrecorded tax liabilities or pending litigation reserves.

Prepaid income or deposits you owe back.

Example: Add a contingent warranty reserve of 12,000 and an unrecorded tax provision of 10,000.

Adjusted Total Liabilities:

Previous liabilities 230,000:

230,000 + 12,000 = 242,000

242,000 + 10,000 = 252,000

Adjusted Total Liabilities = 252,000

Adjusted Net Worth = Adjusted Assets − Adjusted Liabilities

From above:

632,000 − 252,000 = 380,000

Adjusted Net Worth = 380,000

This adjusted number reflects nearer-to-market balance sheet equity. But for many buyers and investors, the economic value of a business includes earnings potential and intangible assets.

Buyers often value businesses based on earnings (cash flow) rather than just assets. To use this approach:

Choose a profit measure — usually Seller’s discretionary earnings (SDE) for small owner-operated firms, or EBITDA for larger companies.

Normalize for owner’s unusual salary, one-off expenses, and non-recurring revenues.

Example income statement (last year):

Net profit (after owner's salary): 60,000

Owner’s salary (includes personal perks): 50,000

Non-recurring legal settlement (expense): 10,000

Non-operating income (one-off sale): 5,000

Calculate SDE (step-by-step):

Start with Net profit: 60,000

Add back Owner’s salary: 60,000 + 50,000 = 110,000

Add back non-recurring legal expense: 110,000 + 10,000 = 120,000

Subtract non-operating income that inflates profit: 120,000 − 5,000 = 115,000

Normalized SDE = 115,000

Small businesses are often sold at a multiple of SDE or EBITDA. Multiples depend on industry, growth, risk, and deal structure. Typical ranges:

Small service businesses: 1–3 × SDE

Profitable SMBs with growth: 3–5 × SDE

Larger firms with recurring revenue: 6–10+ × EBITDA

If comparable sales suggest a multiple of 3 × SDE:

Business value (income approach) = 115,000 × 3 = 345,000

A prudent valuation considers both:

Adjusted net worth (asset-based) = 380,000

Income-based value (SDE multiple) = 345,000

Reconciling: For many small businesses, you might use the higher of the two if assets are unique, or weight them: e.g., 60% income approach + 40% asset approach.

Weighted value:

Income component: 345,000 × 0.6 = 207,000

Asset component: 380,000 × 0.4 = 152,000

Total weighted value = 207,000 + 152,000 = 359,000

Final estimated business net worth (market value) ≈ 359,000

Apply discounts/premiums:

Lack of marketability discount for small privately-held firms (10%–35%).

Control premium if buyer gains control (often applies in larger deals).

Industry risk premium for volatile sectors.

If you apply a 10% marketability discount:

359,000 − (359,000 × 0.10) = 359,000 − 35,900 = 323,100

Rounded: 323,100 — the estimated fair market net worth a buyer might pay.

Look for recent sales of similar businesses (multiples, price/EBITDA).

Engage a business valuator or broker for a formal valuation if the stake or sale value is material.

Remember valuation is both art and science; different methods can produce different answers—document your assumptions.

Up-to-date balance sheet & income statements

Revalued fixed assets & inventory adjustments

Complete list of liabilities (including contingents)

Normalized owner’s salary and one-off items

Choice of earnings metric (SDE or EBITDA)

Appropriate multiple from market comps

Adjustments for marketability, control, and risk

Supporting appraisals (real estate, equipment)

Professional review if selling, buying, or borrowing

Don’t double-count goodwill: If you already include goodwill in asset revaluation, avoid inflating with an aggressive earnings multiple.

Be conservative with multiples: Overly optimistic multiples lead to unrealistic valuations.

Document assumptions: Future buyers and lenders will ask “why” — justify every adjustment.

Use multiple methods: Asset and income approaches together give a more robust picture.

Calculating business net worth starts with a simple assets-minus-liabilities equation but becomes far more valuable when you adjust for market realities, normalize earnings, and apply appropriate valuation methods. Whether you’re preparing to sell, attract financing, or simply measure your company’s health, this step-by-step method helps you move from book equity to a defensible, market-based net worth.

Dharmendra’s Health Update: Family Denies Rumors, Salman Visits

False rumors about Dharmendra’s health denied by family. Salman Khan visits veteran actor, wishing h

Rangers End Home Slump with 6-3 Win Over Predators

Artemi Panarin scored twice and Alexis Lafreniere added a goal and two assists as the New York Range

Thuraya-4 Launch Boosts Satellite Connectivity in South Africa

Thuraya-4 rollout enhances South Africa’s satellite coverage, extending reliable communication to re

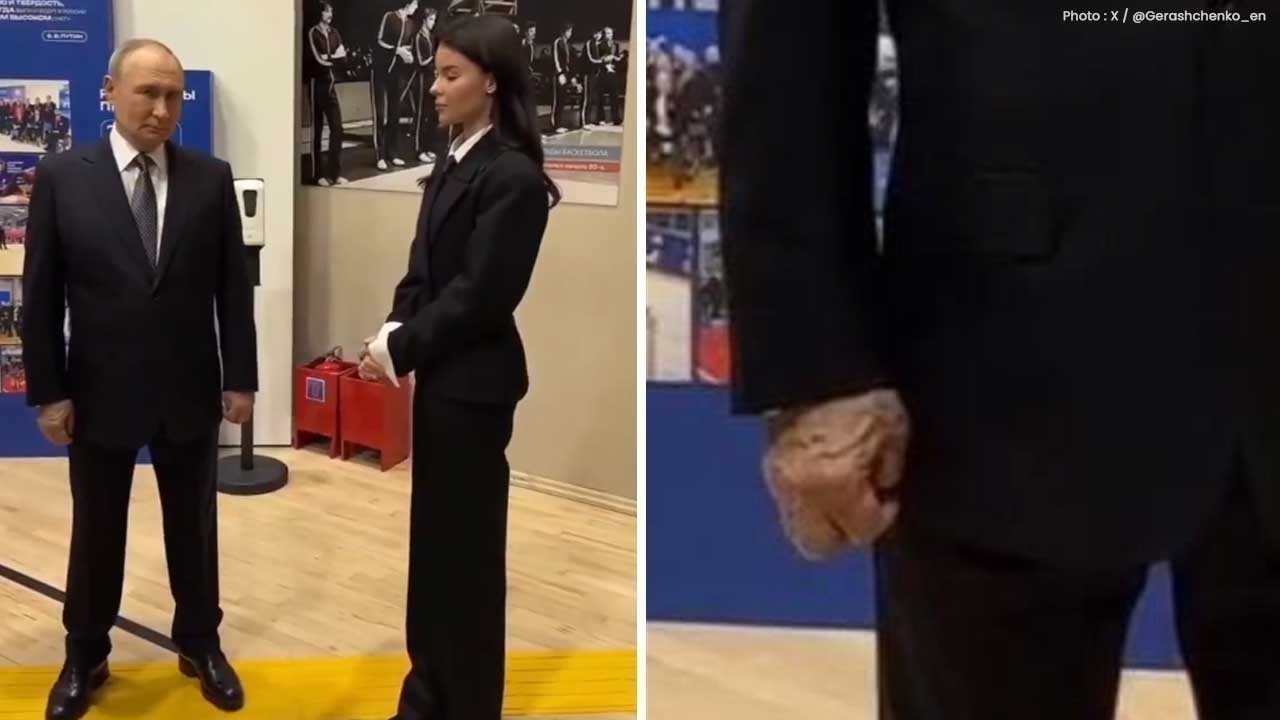

Vladimir Putin’s Swollen Hand Video Fuels Health Speculations

Vladimir Putin’s swollen hand sparks new health speculations as viral video raises concerns about th

Tower Semiconductor Shares Surge on AI Chip Demand

Tower Semiconductor expects Q4 revenue jump on AI and data-center chip demand, sending shares to a 2

Lucky Ali Hints Regret Over Javed Akhtar Spat

Lucky Ali regrets being rude to Javed Akhtar, offers apology if given a chance after their recent ve

EU Eyes Huawei & ZTE Exit from Member States Networks

EU explores measures to remove Huawei and ZTE from telecom networks, aiming for secure digital infra

Rangers End Home Slump with 6-3 Win Over Predators

Artemi Panarin scored twice and Alexis Lafreniere added a goal and two assists as the New York Range

Chase Koepka Eyes Comeback at LIV Golf Promotions Event

Chase Koepka, fully recovered from injury, is aiming to reclaim his spot in the LIV Golf League at t

US Sprinter Bracy Banned 45 Months for Doping Offence

World silver medallist Marvin Bracy-Williams has been banned for 45 months after testing positive fo

IOC Reviews Rules for Transgender Athletes in Olympics

The International Olympic Committee is reviewing universal rules for transgender athletes to ensure

Saba Azad Cheers Hrithik Roshan's Niece Bakery Launch

Hrithik Roshan's niece Suranika opens The Moon Beam Bakery; Saba Azad shares a heartfelt Instagram s

Jets Make History with Two Special Teams Touchdowns

The New York Jets made franchise history with two special teams touchdowns in one quarter, defeating

Chargers Beat Steelers 25-10 as Herbert, Defense Shine

The Los Angeles Chargers beat the Pittsburgh Steelers 25-10 at home. Justin Herbert impressed while

Rams Beat 49ers as Adams Injures Oblique Late in Game

The Los Angeles Rams beat the San Francisco 49ers 42-26, but Davante Adams left in the fourth quarte