Post by : Anish

For decades, buying a home was considered the hallmark of success, security, and smart money management. Renting? That was often seen as temporary, even wasteful. But in 2025, that narrative is being disrupted. High interest rates, soaring property prices, and evolving lifestyles are pushing a new mindset to the forefront—maybe renting isn’t a waste after all.

Across global cities—from Dubai to New York, London to Mumbai—people are questioning whether owning property is still the best path to financial freedom. For many, the answer isn’t so clear. In fact, a growing number of financially savvy individuals are choosing to rent by choice, not by force.

The assumption that rent is “lost money” overlooks the true cost of ownership—mortgage interest, maintenance, taxes, insurance, and reduced mobility. It’s time to unpack the myths and understand why renting may be a smarter, more flexible, and financially responsible choice in today’s housing market.

At first glance, owning seems like a financially sound move: monthly payments go toward something you "own", not a landlord. But that’s only part of the picture.

Here are some of the major hidden costs many overlook:

Interest on loans: In high-interest environments, you may pay more in interest than in principal for many years.

Property taxes: These are recurring costs that increase as property values rise.

Maintenance and repairs: From plumbing to roofing, home upkeep is your responsibility and can cost thousands annually.

Insurance: Home insurance is mandatory in most cases and can be costly, especially in high-risk areas.

Opportunity cost: The large down payment required to buy a home could instead be invested for higher returns elsewhere.

When all these factors are accounted for, the "value" of ownership becomes murkier. Renting, in contrast, offers predictable costs, no repair responsibilities, and often frees up capital for other investments.

In a post-pandemic world, people are valuing flexibility more than ever. Remote work, digital nomad lifestyles, and global mobility have reduced the appeal of being tied to one location.

Renting supports this lifestyle. Whether for career moves, lifestyle upgrades, or personal freedom, renting allows:

Quick relocation without having to sell property

Less paperwork and legal hurdles

Ability to test out different neighborhoods or cities before committing

For young professionals, entrepreneurs, or anyone uncertain about where life may take them in 5–10 years, renting becomes a logical, lifestyle-based decision—not a financial mistake.

One of the biggest reasons people buy homes is the belief that real estate always appreciates. But that’s not always true.

Markets fluctuate. Neighborhoods change. Maintenance costs rise. Some owners end up selling at a loss, especially when forced to move during a downturn. Unlike stocks or mutual funds, real estate is illiquid—meaning it’s not easy to sell quickly or without cost.

In contrast, renters can invest their extra capital elsewhere—stock markets, index funds, side businesses—and often enjoy better returns without the complications of ownership.

In cities like Dubai, where rental yields are strong, many investors buy homes to rent out—not to live in. Ironically, it’s renters who often enjoy better financial flexibility.

It’s often easier for renters to live in premium locations than buyers. Buying in city centers is usually unaffordable for most, but renting might still be within reach.

Think about this:

A central 2-bedroom apartment may cost AED 3 million to buy but only AED 9,000/month to rent.

That down payment of AED 600,000 could be invested elsewhere.

Meanwhile, the renter enjoys top-tier amenities, convenience, and lifestyle access without the burden of long-term debt.

This trend is especially common in luxury real estate. Renters get access to gyms, pools, security, and prime views—often for less than the monthly cost of a mortgage and maintenance combined.

Homeownership ties up a significant portion of your finances in a non-liquid asset. Renters, on the other hand, often:

Save more

Invest more frequently

Maintain emergency funds more effectively

Without unexpected repair bills or rising property tax surprises, renters can plan their finances with greater stability. Fixed rent agreements and freedom from hidden homeownership costs give renters a chance to manage money with clarity.

It’s not uncommon for financially aware renters to have strong portfolios and diversified assets—something not always possible when your equity is locked in bricks and mortar.

Renting isn’t for everyone, but it makes strong financial and practical sense if:

You plan to move within 3–5 years

You don't have a large down payment saved

You're investing in building a business or other ventures

You want to avoid home maintenance responsibility

Your income is unstable or variable

You prefer flexibility over fixed commitments

In such scenarios, renting offers more freedom, fewer surprises, and less financial stress.

For years, renters were viewed as people who couldn’t afford to buy. But that mindset is changing fast. High-profile finance influencers, real estate advisors, and even wealthy professionals are now promoting “rent by choice” as a viable financial strategy.

Especially among Gen Z and millennials, the idea of being “house-poor” (spending most income on the home) is unappealing. They prioritize:

Experiences over possessions

Access over ownership

Flexibility over long-term debt

The new wave of financially literate individuals isn’t rushing to buy—they’re questioning, comparing, and choosing wisely.

Despite all the advantages of renting, ownership still has its place—when done right. Consider buying when:

You plan to stay in one location for at least 7–10 years

You have stable income and emergency savings

You’re buying below your means—not stretching your finances

You understand all the costs involved and can handle them

You want a long-term asset to pass on or live in post-retirement

Buying a home should be a long-term decision, not a rushed emotional one. In the right context, it builds security. But when done prematurely, it can become a financial burden.

In 2025, the idea that “rent money is dead money” no longer holds up. It’s not about owning vs renting. It’s about understanding your life stage, your financial priorities, and your long-term goals.

Renting gives you:

Time to build a better down payment

Freedom to move for career or family

Ability to invest in multiple income streams

Peace of mind from fixed and manageable monthly costs

If those benefits outweigh the pros of ownership at your current stage, then renting is not a waste—it’s a smart, strategic move.

This article is for general information and editorial purposes only. It does not constitute financial or real estate advice. Readers are encouraged to assess their personal circumstances and consult a qualified advisor before making housing or investment decisions.

India vs West Indies Test Series 2025: A Clash of Heritage and New Beginnings

The 2025 India vs West Indies Test series promises fierce cricketing battles with new leadership, em

Lal Bahadur Shastri Birth Anniversary: Remembering India’s Humble Prime Minister

Lal Bahadur Shastri, India’s second Prime Minister, is remembered for his humility, integrity, and s

Korean Scientists Teach Robots to “Forget” for Faster Navigation

New Physical AI helps autonomous robots forget outdated info, boosting efficiency in factories and l

Abu Dhabi Q2 GDP Hits AED306B, Non-Oil Sectors Lead Growth

Abu Dhabi’s Q2 2025 GDP reaches AED306B, with non-oil sectors driving record growth in manufacturing

DEWA Joins Global vPAC Alliance, Leading MENA Power Sector

DEWA becomes first MENA utility in vPAC Alliance, advancing smart grids, digital networks, and globa

Jane Goodall Dies at 91: Legendary Voice for Wildlife Lost

Renowned primatologist Jane Goodall passes at 91, leaving a legacy of groundbreaking chimpanzee rese

UAE to Launch World-Class Passenger Rail with Etihad & Keolis

Etihad Rail partners with Keolis to introduce world-class passenger rail in UAE by 2026, offering se

Fusion of Tradition and Modernity Balancing Heritage and Modern Life

Explore how tradition and modernity blend to shape culture innovation and society creating a balance

Top Nutrient Rich Foods Every Woman Should Eat for Better Health & Energy

Discover top nutrient rich foods every woman should eat to boost energy immunity and overall healt

Fibre for Weight Loss How High Fibre Foods Help You Shed Pounds Naturally

Learn how fibre helps you lose weight naturally keeps you full boosts digestion and supports a healt

Small Weight Loss Tips to Protect Your Knees

Even small weight loss can reduce knee pain improve mobility and protect joints Learn simple tips to

Men s Grooming & Skin Care Guide Tips for Healthy Skin and Confidence

Discover the ultimate men s grooming and skin care guide with tips for healthy skin hair care and co

Body Contouring & Slimming in Dubai Safe Non Surgical Ways to Reshape Your Body

Discover safe effective body contouring & slimming treatments in Dubai to reduce fat tighten skin an

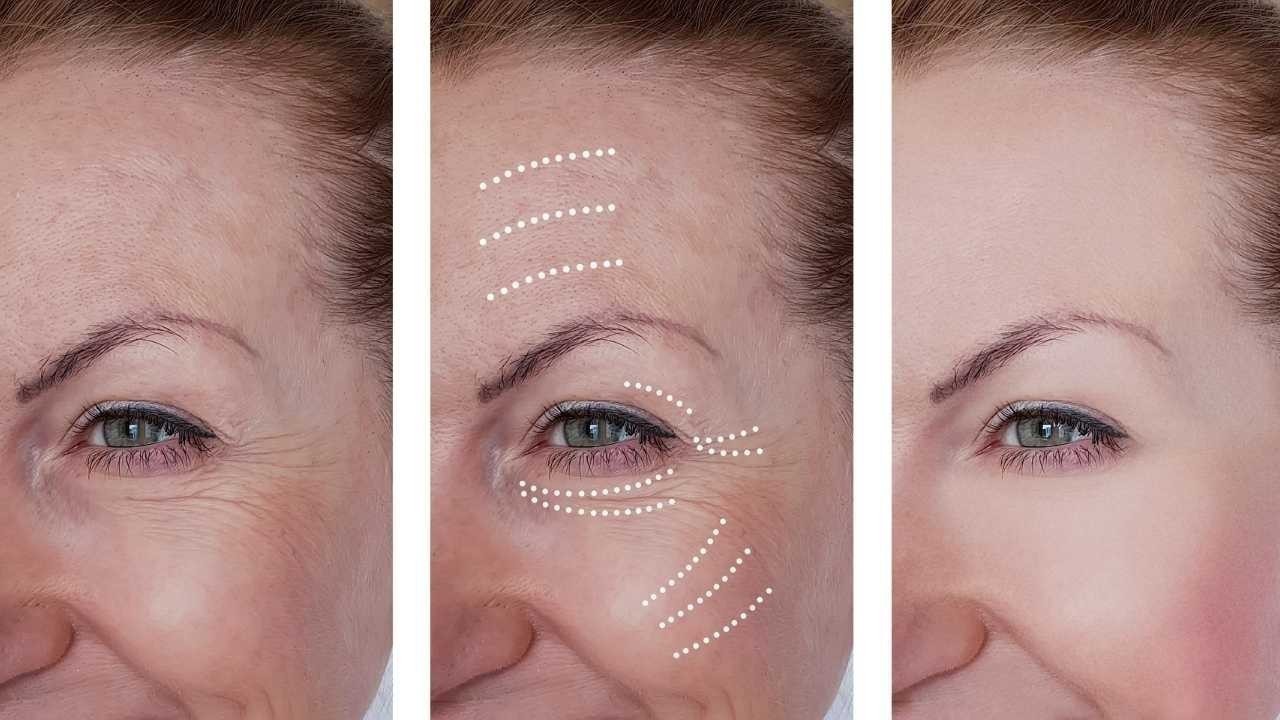

Anti Aging & Rejuvenation in Dubai Secrets to Younger Skin & Wellness

Discover anti aging & rejuvenation in Dubai From Botox to natural care explore safe treatments for y

Lip Tanning & Sun Damage Causes Signs Prevention & Treatments

Learn about lip tanning and sun damage Discover causes signs prevention and treatments to keep your