Post by : Soumya Jit

Real estate has long been a magnet for investors in the UAE. From Dubai’s iconic skyscrapers to Abu Dhabi’s expanding business districts, property remains one of the most secure and rewarding asset classes. Yet, direct ownership isn’t always possible. High upfront costs, property management issues, and market risks often make it difficult for average investors to buy real estate.

This is where REITs (Real Estate Investment Trusts) and real estate funds step in. These investment vehicles allow individuals to tap into the UAE’s thriving property sector without having to own or manage physical real estate. In 2025, with the UAE continuing to attract global investors, REITs and funds are becoming increasingly popular as an accessible and profitable alternative.

A Real Estate Investment Trust (REIT) is a company that owns or finances income-producing real estate. Instead of purchasing an apartment, villa, or office directly, investors can buy shares in a REIT and indirectly gain exposure to multiple properties.

Most REITs in the UAE are listed on local stock exchanges, which means investors can easily buy or sell their shares just like regular stocks. REITs typically generate revenue from renting out their properties and distribute a significant portion of that income—often 80–90%—as dividends to shareholders.

Their portfolios may include residential towers, commercial offices, shopping malls, hotels, and even logistics hubs.

Unlike REITs, which are structured as companies, real estate funds work like mutual funds but focus on property-related assets. They pool money from different investors and allocate it into property projects, REITs, or mortgage-backed securities.

Some common types of real estate funds available in the UAE include:

Open-ended funds – Investors can enter and exit anytime, with the value tied to the fund’s net asset value.

Closed-ended funds – Fixed number of shares, usually listed on stock exchanges.

Private funds – Tailored for high-net-worth individuals or institutional investors.

Real estate funds are more actively managed, making them suitable for investors who prefer a professional team handling the portfolio.

In 2025, REITs and real estate funds in the UAE stand out for several reasons:

Accessibility – Investors can start with small amounts, often under AED 1,000, compared to millions needed for direct property ownership.

Diversification – Exposure to multiple properties reduces reliance on a single asset’s performance.

Passive Income – With REITs distributing regular dividends, investors earn rental income without dealing with tenants or property upkeep.

Liquidity – Unlike physical property, REIT shares can be sold on the stock exchange within minutes.

Strong Regulation – The UAE’s Securities and Commodities Authority (SCA) regulates these vehicles, ensuring transparency and investor protection.

Some of the most prominent players in the UAE market include:

Emirates REIT – One of the earliest and largest REITs in Dubai, with a diverse portfolio of offices, schools, and retail spaces.

ENBD REIT – Managed by Emirates NBD Asset Management, offering exposure to residential and commercial assets.

Al Mal Capital REIT – A Shariah-compliant option focusing on healthcare, industrial, and education sectors.

Mubadala real estate funds – Backed by Abu Dhabi’s sovereign wealth fund, these target large-scale, long-term property projects.

Each fund or REIT has a unique investment strategy, so investors should review their focus areas, dividend history, and management before committing.

Step 1: Open a brokerage account – Required for trading listed REITs on UAE exchanges.

Step 2: Research available options – Compare portfolios, yields, and management strategies.

Step 3: Start with small amounts – Many REITs allow entry with just a few hundred dirhams.

Step 4: Explore real estate funds – Banks and asset managers in the UAE offer both open-ended and closed-ended real estate funds.

Step 5: Stay updated on market conditions – Property demand, tourism trends, and interest rate changes can all impact returns.

No investment is without risk, and REITs are no exception.

Market volatility – REIT share prices can fluctuate with economic shifts.

Dividend cuts – Lower rental income could reduce payouts.

Interest rate sensitivity – Rising interest rates may make REITs less attractive compared to fixed-income securities.

Management risk – Poorly managed funds may underperform.

Liquidity risk in private funds – Some funds may lock in investments for years.

While buying property gives investors direct control and potential capital appreciation, it requires high capital, ongoing expenses, and management responsibilities. REITs and funds, on the other hand, provide low-cost entry, professional management, and easier liquidity, making them attractive for investors seeking flexibility.

Q1. Can non-residents invest in UAE REITs?

Yes, both residents and international investors can access listed REITs via UAE brokerage accounts.

Q2. Are there Shariah-compliant REITs in the UAE?

Yes. Options like Al Mal Capital REIT follow Shariah principles.

Q3. What kind of returns can I expect in 2025?

Dividend yields typically range between 5% and 8%, depending on the REIT’s portfolio and market conditions.

Q4. Do I need a lot of money to start?

No. Investors can start with a few hundred dirhams in listed REITs.

Q5. Are REITs safer than direct property investment?

They carry less financial risk due to diversification and liquidity, but they are still subject to market fluctuations.

Most Expensive Villas and Apartments Sold in Dubai 2025: Record Deals

In 2025, Dubai has broken multiple luxury property records with staggering sales in ultra-prime loca

Top 5 Areas in Dubai for Highest Rental Yields in 2025

Dubai remains a strong market for rental property investors in 2025. This article highlights the top

Sharjah Ruler Condoles Sheikh Sultan bin Khalid Al Qasimi

His Highness Sheikh Dr Sultan bin Mohammed Al Qasimi offers condolences on the passing of Sheikh Sul

Abu Dhabi Hosts Global Social Care Forum 2025

Abu Dhabi opens the 2nd Social Care Forum, highlighting global innovation, AI in social services, an

Sholay’s Original Ending Returns at IFFS 2025

Bollywood classic Sholay (1975) screens with its original climax at the Indian Film Festival of Sydn

OpenAI, Oracle & SoftBank Launch 5 US AI Centres

OpenAI, Oracle, and SoftBank plan five new US AI data centres, creating 25,000+ jobs and boosting $4

FII9 2025: Riyadh Hosts Global Investment Summit

FII9 2025 in Riyadh gathers world leaders, investors, and experts to discuss economic growth, innova

The 5 Most Beautiful Jewels of Princess Diana Symbols of Love Style and Legacy

Explore Princess Diana s 5 most beautiful jewels from her sapphire ring to iconic tiaras each telli

8 Protein Powerhouses for Healthy Hair Growth Strong Shiny Hair Naturally

Boost hair growth naturally with 8 protein rich foods like eggs fish nuts and quinoa for stronger

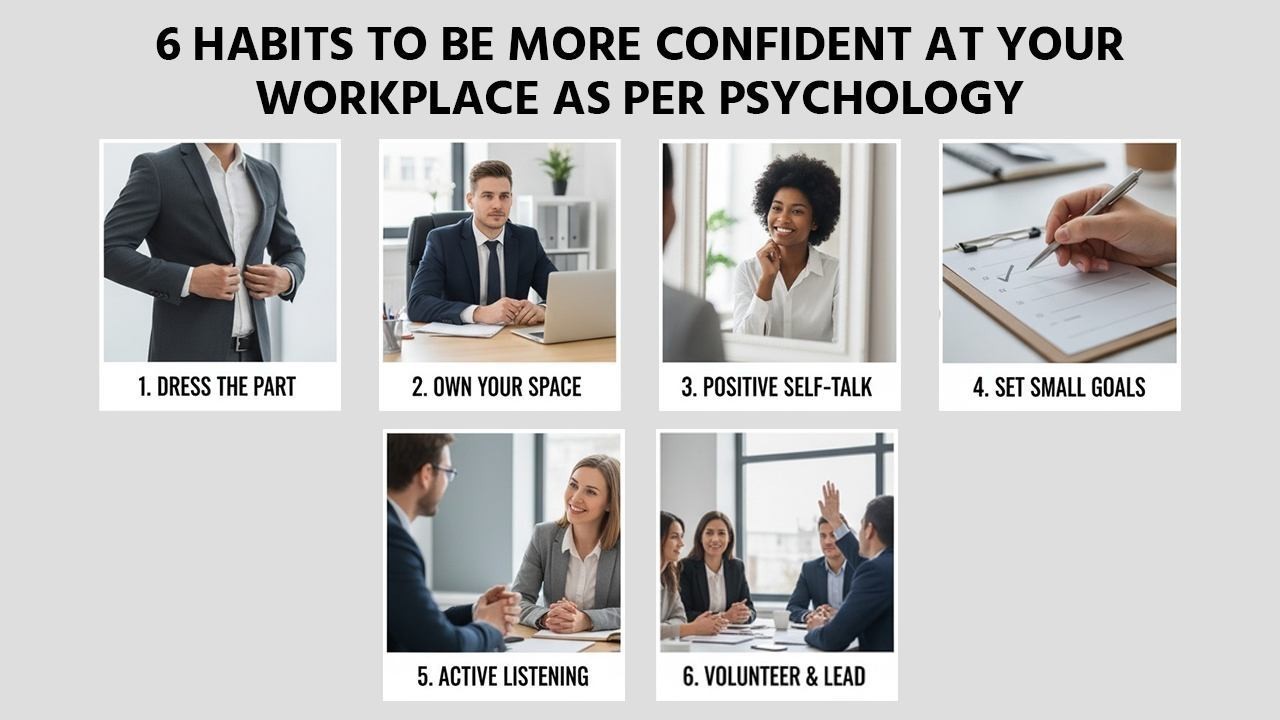

6 Psychology Backed Habits to Boost Confidence at Work

Discover 6 psychology backed habits to build confidence at work Simple effective tips to improve s

How to Achieve Glass Skin Naturally at Home Without Expensive Products

Discover simple steps to get glowing glass skin at home with natural care hydration and remedies no

OPPO A6 Pro 5G Review Powerful Mid Range Smartphone with Long Battery & AI Cameras

Explore OPPO A6 Pro 5G 7000mAh battery 50MP camera MediaTek Dimensity 7300 sleek design and fast 80W

Morning and Night Vegetarian Diet Tips for Flawless Skin Naturally

Discover simple morning and night vegetarian diet tips to nourish your skin prevent acne and achie

Legends Who Redefined Sports: Athlete Profiles That Inspire Generations

Discover the inspiring journeys of Messi, Ronaldo, Serena Williams, Virat Kohli, and Usain Bolt—lege

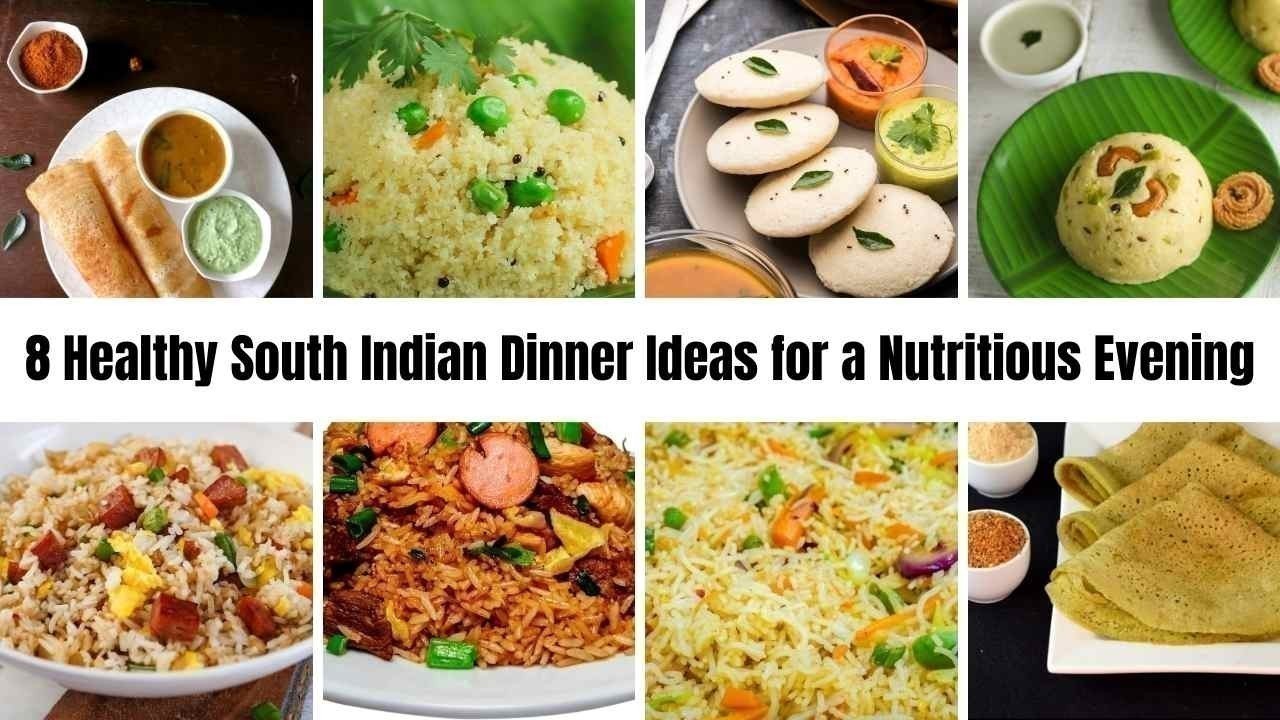

8 Healthy South Indian Dinner Ideas for a Nutritious and Delicious Evening

Discover 8 healthy South Indian dinner ideas that are nutritious light and easy to make perfect f