Post by : Anish

Dubai’s high-end real estate market has seen impressive momentum this year. Demand from wealthy buyers, limited supply in trophy locations, and continued interest in beachfront and branded residences are pushing prices to new heights. Villas and high-end apartments in prestige communities are not just status symbols; they are investment statements.

Several standout sales have captured global attention, setting new benchmarks in sale price and price per square foot. These record transactions are reshaping expectations in what buyers will pay for luxury, exclusivity, and prime location in Dubai.

One of the most headline-making property deals in 2025 was the sale of a villa in Emirates Hills known as The Marble Palace. Inscribed in luxury with sweeping architecture, marble finishes, domed ceilings, and sprawling grounds, this villa fetched AED 425 million, making it the most expensive villa transaction in the first half of the year.

Another trophy villa set a new high when a six-bedroom villa on Jumeirah Bay Island changed hands for AED 330 million. This property, lauded for its panoramic views, exclusive island setting, and ceiling heights over 13 meters in places, confirmed Jumeirah Bay Island’s status among elite villa addresses.

On Palm Jumeirah, a Signature Villa spanning over 10,900 square feet sold for AED 161 million, nearly setting a new record for luxury villas on the island. The property features multiple living and entertainment areas, a private cinema, and a pool deck with direct views of Atlantis. The sale also achieved a very high rate per square foot, among the highest recorded in Dubai in 2025.

One of the most expensive apartment deals was closed at The One at Palm Jumeirah. A five-bedroom penthouse there sold for AED 275 million, making it one of the priciest apartments in Dubai’s resale market. This deal underscores the premium placed on location, views, and high-end finishing.

A five-bedroom apartment at Bulgari Lighthouse fetched AED 137 million, showcasing how branded residences with high luxury standards continue to command strong premiums.

Another standout apartment sale: a five-bedroom residence at Six Senses The Palm changed hands allegedly for AED 130 million, emphasizing that ultra-luxury themed resorts and high-brand names are strong value drivers.

Among townhouses, a property in Umm Suqeim 2 sold for AED 72 million, and other townhouses in upscale communities saw sales in the AED 30-70 million range, depending on size, finish, and plot amenities.

Several factors combine to make these sales possible:

Scarcity and Location: Properties in ultra-prime locations like Emirates Hills, Palm Jumeirah, Jumeirah Bay Island are limited in supply. Buyers are willing to pay far more for exclusivity, views, and established prestige.

Design and Amenities: Trophy homes often feature custom architecture, luxury finishes, large outdoor spaces, private pools, cinema rooms, and views of the sea or iconic city skylines. Such features push up both absolute price and per-square-foot rate.

Branding and Developer Reputation: Branded luxury residences (Bulgari, etc.), or homes developed by well-known luxury developers tend to command higher valuations.

Global Demand: Dubai continues to attract high-net-worth individuals from around the world looking for second homes, investment properties, or trophy real estate, especially in stable, internationally accessible markets.

Luxury Per Square Foot Pricing: Many of the record deals also hit very high price per square foot metrics, not just the headline price, reflecting how buyers are paying extra for prime plots, high quality, finishes, and views.

These record deals have ripple effects throughout Dubai’s property sector:

Benchmarking: Every time a villa or apartment at ultra-high prices changes hands, it sets new benchmarks. Surrounding properties can appreciate as comparators update.

Perception of Value: When high-net-worth buyers pay record sums, it increases perception of Dubai as a luxury destination, which can attract more global capital.

Pricing Pressure: Developers may use these benchmark sales to set higher pricing for new luxury units, particularly in similarly exclusive areas.

Segmentation: The luxury market becomes further stratified — those premium elite residences are increasingly distinct, with value drivers different from more mainstream luxury or mass market properties.

Even among record deals, there are some risks to consider:

Liquidity: Ultra-luxury properties can be harder to resell. The buyer pool is limited. Holding costs, maintenance, taxes, and service charges are also much higher.

Overvaluation Risks: If many high-valued listings become aspirational rather than transactional, price growth may outpace what sustainable demand justifies.

Economic Sensitivities: Luxury property values are sensitive to global economic conditions, change in taxation policies, visa or regulatory changes, and currency fluctuations.

Supply of Ultra-Prime Products: If supply increases significantly in trophy villa segments, or new islands and mega-projects come up, competition may squeeze margins.

Based on these record transactions, some patterns emerge among luxury property buyers:

Desire for waterfront and island properties with direct sea views or sea access is very strong.

Preference for extreme luxury and customisation: buyers are choosing properties with outstanding luxury features — terraces, private cinema, large plot sizes, bespoke finishes.

Privacy and exclusivity remain key: gated communities, islands, villas rather than apartments tend to dominate the highest end.

Location remains king: despite global economic fluctuations, prime addresses retain value, which encourages buyers to invest in well-known luxury neighbourhoods.

Many buyers in the record deals are not just locals — international buyers seeking global homes or alternative residential bases are influential.

Looking ahead through the rest of 2025 and into 2026:

Ultra-prime demand is likely to stay strong because it is less sensitive to typical market cycles (e.g., rate hikes, inflation) compared to mid-segment markets.

Developers with ultra-luxury projects will likely push new inventory, but supply remains limited in many trophy areas, which may help support prices.

Regulatory and policy factors, like visa incentives or foreign ownership laws, will remain important in attracting global wealth to Dubai property.

Macro-economic conditions globally, such as capital flows, tax regulations, currency stability, will affect buyer confidence.

Dubai’s luxury real estate market in 2025 has seen multiple record-breaking sales for both villas and apartments. From the AED 425 million Marble Palace in Emirates Hills to the AED 275 million penthouse at Palm Jumeirah, and the AED 161 million Signature Villa on Palm Jumeirah, these deals emphasize how far the city has come in staking its claim as a top global hub for luxury homes.

These transactions are more than just headlines; they reflect enduring demand for the most exclusive real estate, where location, architecture, exclusivity, and brand carry immense weight. For investors and luxury buyers, such deals reaffirm that in Dubai, ultra-prime property remains a place where buyers still pay top dollar for top prestige.

This article is based on property transactions and market reports available as of mid-2025. Prices, availability, and records may change. Property valuations are subject to verification and may vary depending on exact plot, finish, measurement standards, and legal/title status.

Most Expensive Villas and Apartments Sold in Dubai 2025: Record Deals

In 2025, Dubai has broken multiple luxury property records with staggering sales in ultra-prime loca

Top 5 Areas in Dubai for Highest Rental Yields in 2025

Dubai remains a strong market for rental property investors in 2025. This article highlights the top

Sharjah Ruler Condoles Sheikh Sultan bin Khalid Al Qasimi

His Highness Sheikh Dr Sultan bin Mohammed Al Qasimi offers condolences on the passing of Sheikh Sul

Abu Dhabi Hosts Global Social Care Forum 2025

Abu Dhabi opens the 2nd Social Care Forum, highlighting global innovation, AI in social services, an

Sholay’s Original Ending Returns at IFFS 2025

Bollywood classic Sholay (1975) screens with its original climax at the Indian Film Festival of Sydn

OpenAI, Oracle & SoftBank Launch 5 US AI Centres

OpenAI, Oracle, and SoftBank plan five new US AI data centres, creating 25,000+ jobs and boosting $4

FII9 2025: Riyadh Hosts Global Investment Summit

FII9 2025 in Riyadh gathers world leaders, investors, and experts to discuss economic growth, innova

The 5 Most Beautiful Jewels of Princess Diana Symbols of Love Style and Legacy

Explore Princess Diana s 5 most beautiful jewels from her sapphire ring to iconic tiaras each telli

8 Protein Powerhouses for Healthy Hair Growth Strong Shiny Hair Naturally

Boost hair growth naturally with 8 protein rich foods like eggs fish nuts and quinoa for stronger

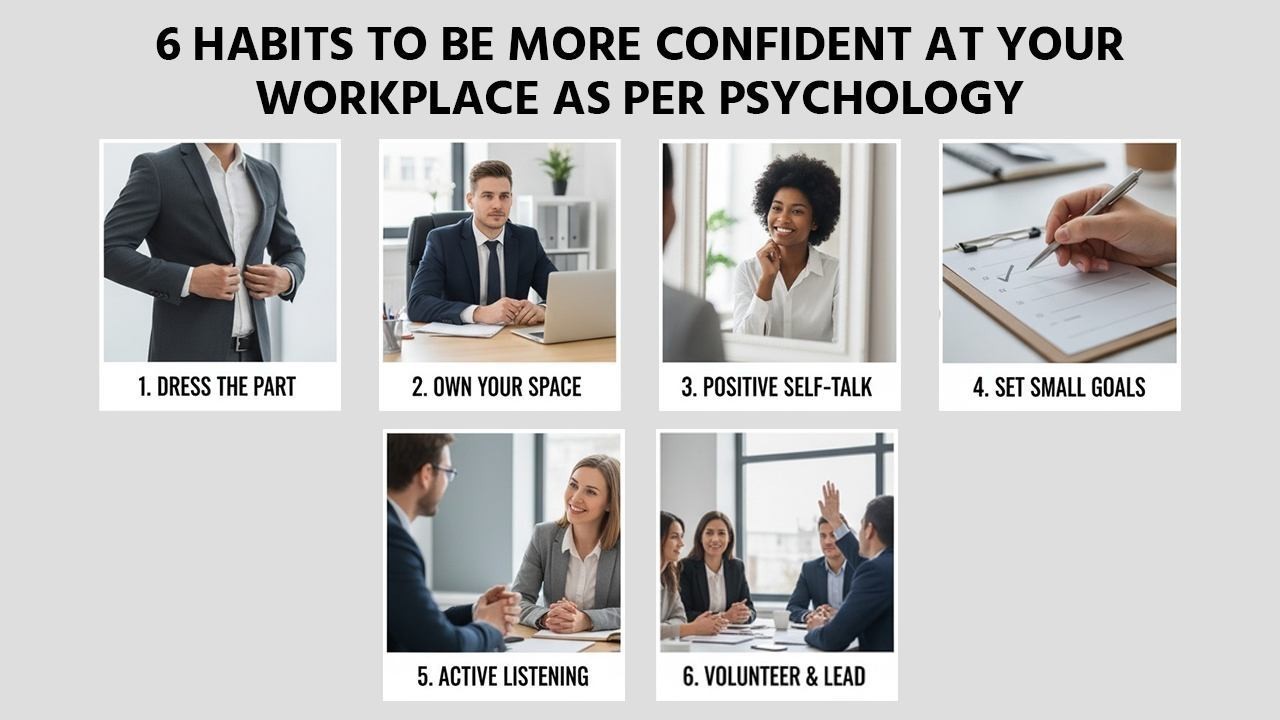

6 Psychology Backed Habits to Boost Confidence at Work

Discover 6 psychology backed habits to build confidence at work Simple effective tips to improve s

How to Achieve Glass Skin Naturally at Home Without Expensive Products

Discover simple steps to get glowing glass skin at home with natural care hydration and remedies no

OPPO A6 Pro 5G Review Powerful Mid Range Smartphone with Long Battery & AI Cameras

Explore OPPO A6 Pro 5G 7000mAh battery 50MP camera MediaTek Dimensity 7300 sleek design and fast 80W

Morning and Night Vegetarian Diet Tips for Flawless Skin Naturally

Discover simple morning and night vegetarian diet tips to nourish your skin prevent acne and achie

Legends Who Redefined Sports: Athlete Profiles That Inspire Generations

Discover the inspiring journeys of Messi, Ronaldo, Serena Williams, Virat Kohli, and Usain Bolt—lege

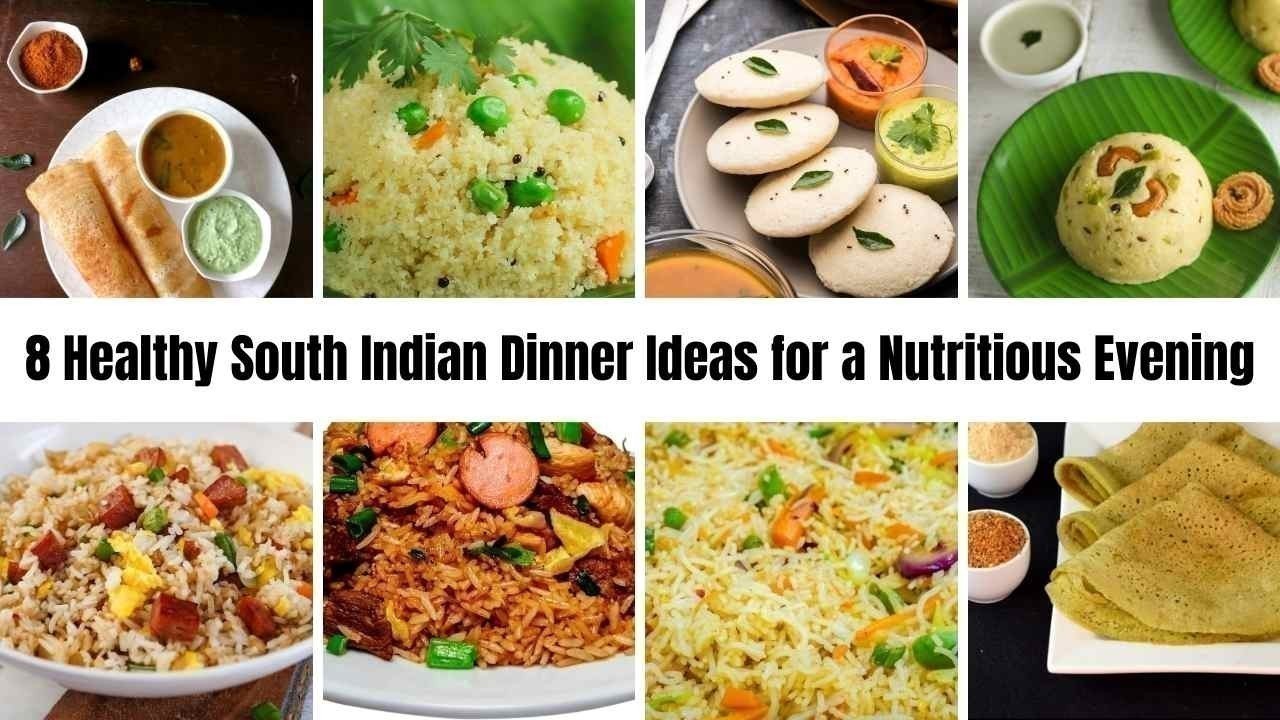

8 Healthy South Indian Dinner Ideas for a Nutritious and Delicious Evening

Discover 8 healthy South Indian dinner ideas that are nutritious light and easy to make perfect f