Post by : Zayd Kamal

How Stock Market Ups and Downs Affect Your Investments

The stock market is often described as a roller coaster of financial ups and downs. Investors who understand these fluctuations are in a better position to make informed decisions and manage their investments effectively. Whether you’re a beginner or an experienced investor, understanding stock market volatility is essential to navigating this complex system. In this article, we will explore the key factors that drive the stock market's ups and downs and provide tips for dealing with market volatility.

What Causes Stock Market Volatility?

Stock market volatility refers to the frequency and extent of price movements within the market. These fluctuations can happen rapidly and without warning. Several factors contribute to market volatility, including economic factors, geopolitical events, corporate earnings reports, investor sentiment, and interest rates. Economic data such as GDP growth, inflation rates, and unemployment figures play a significant role in stock market behavior. A strong economy typically drives market growth, while signs of a recession or economic slowdown can lead to market declines. Political instability, wars, or changes in government policies can influence investor confidence and result in market uncertainty. The performance of companies, reflected in their earnings reports, also impacts stock prices. Investor sentiment, driven by emotions like fear and greed, can cause dramatic swings in the market, and interest rates set by central banks play a major role by influencing borrowing costs and affecting corporate profits.

The Impact of Market Fluctuations on Investors

For investors, understanding stock market ups and downs is crucial to making informed decisions. While market volatility can create opportunities for profit, it can also lead to significant losses if not managed carefully. Different types of investors may experience volatility in different ways. Long-term investors who are focused on distant goals like retirement are often less affected by short-term fluctuations. They tend to ride out market ups and downs, understanding that the market will likely recover over time. On the other hand, short-term traders who capitalize on rapid price changes are more exposed to the risks of market volatility. These investors rely on the quick pace of market movements to make profits, but they must remain vigilant, as sudden changes in market sentiment can result in significant losses. Investors saving for retirement may also feel vulnerable to market declines, especially if they are near retirement age and cannot afford to wait for a recovery.

Strategies for Navigating Stock Market Volatility

Navigating the ups and downs of the stock market doesn’t have to be overwhelming. By understanding key concepts and implementing sound strategies, investors can better weather the storm during turbulent times. One effective strategy is diversification. By spreading investments across different asset classes, such as stocks, bonds, and real estate, you reduce the impact of a single asset's poor performance on your overall portfolio. Another key strategy is staying focused on long-term goals. When investing for the long term, it's important not to get caught up in short-term market movements. The stock market has a history of growing over time, despite periodic declines. Staying informed is also critical. By keeping up to date with economic trends, company reports, and market conditions, investors can make better decisions and avoid reacting impulsively to every market swing. Additionally, avoiding emotional decisions is key. Fear and greed can drive investors to make poor choices, such as selling during market drops or buying during market peaks. Sticking to a well-thought-out investment strategy helps maintain discipline during volatile periods.

The Importance of Risk Management

While market volatility presents opportunities for investors, it also brings risks. Effective risk management is essential to minimize potential losses. One way to manage risk is by setting stop-loss orders, which automatically sell a stock if its price falls below a certain threshold. This can help limit losses in case the market turns against you. Rebalancing your portfolio is another important strategy. Over time, the value of your investments may change, causing your portfolio to become unbalanced. Rebalancing ensures that your asset allocation remains aligned with your risk tolerance and financial goals. Additionally, some investors may choose to hedge their portfolios using strategies like options contracts or inverse exchange-traded funds (ETFs). These strategies can help offset losses when the market experiences significant downturns.

Disclaimer

The information provided in this article is for general informational purposes only. While we strive to offer accurate and up-to-date content, DXB News Network does not guarantee the completeness, reliability, or accuracy of the information presented. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of DXB News Network. Readers are encouraged to conduct their own research and seek professional advice before making any investment or financial decisions. DXB News Network is not responsible for any actions taken based on the content provided here.

Bitcoin Crashes to $63K as Tech Rout Triggers Crypto Selloff

Bitcoin fell to $63K, its lowest since Oct 2024, as tech stocks slid and metals turned volatile. $1B

Sheikh Mohammed Attends WGS 2026 Leaders Graduation

Dubai Ruler Sheikh Mohammed attended WGS 2026 as 29 young Arab leaders graduated from the Future Gov

UAE Sends 91.6 Tonnes Aid to Flood-Hit Mozambique

Dubai Humanitarian delivers urgent relief supplies to Mozambique floods, helping 38,000+ people with

UAE Honours Global Peacebuilders at 2026 Zayed Award Ceremony

UAE President Sheikh Mohamed bin Zayed honours global peacebuilders, including Aliyev, Pashinyan, an

Shell Q4 Profit Drops 11% but Maintains Big Share Buybacks

Shell’s Q4 net profit fell to $3.3B amid weak oil and chemical markets, yet the company keeps strong

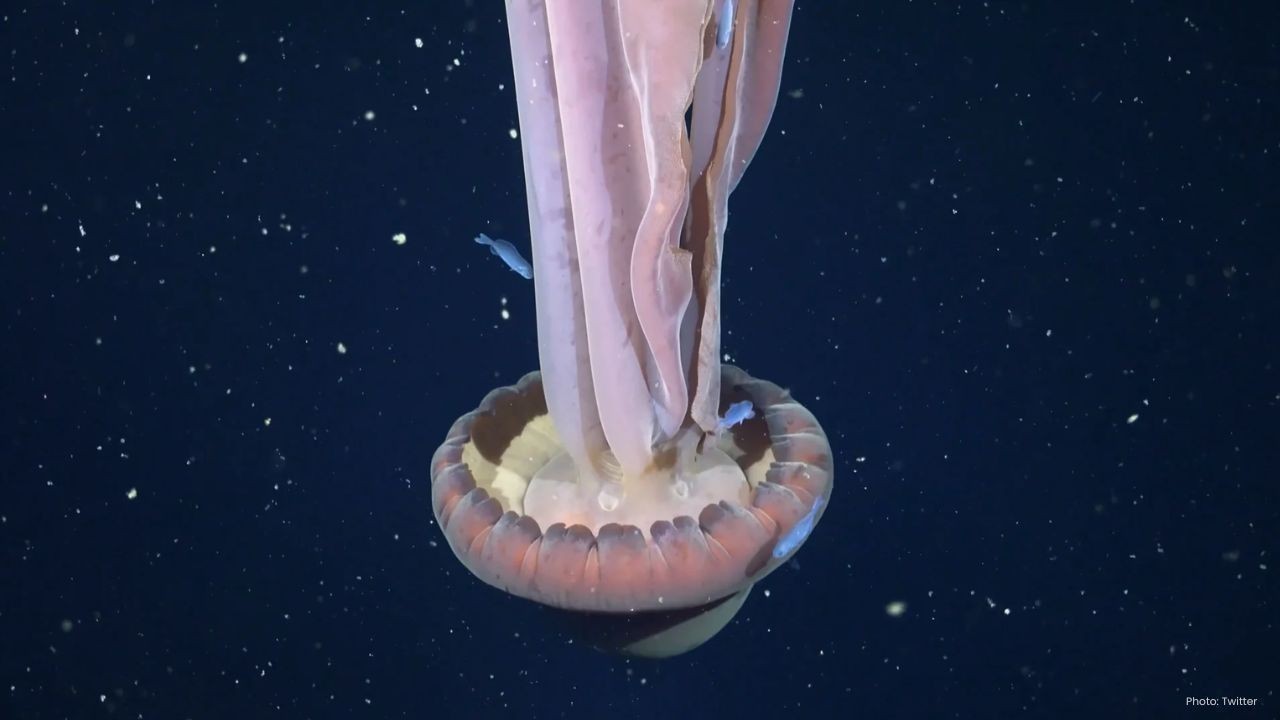

Rare Giant Phantom Jellyfish Spotted Off Argentina Coast

Scientists filmed the rare giant phantom jellyfish at 250m depth off Argentina. Only 126 sightings h

Russia Hits Ukraine Power Grid With Record Missile Barrage

Russia launched 450 drones and 70 missiles on Ukraine, targeting the power grid during extreme cold.

Winter Skin Care: 10 Hydrating Drinks That Give Natural Glass Skin Glow

Learn how simple winter drinks keep your skin hydrated reduce dryness and support a natural glass sk

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin