Post by : Jyoti Singh

Photo: Reuters

Stocks Rally, Yields Dip as Powell Opens Door to September Rate Cut. The financial markets in the United States had an exciting day after Federal Reserve Chairman Jerome Powell gave a strong signal that the central bank could reduce interest rates as early as September. His remarks gave investors hope that the cost of borrowing may soon become cheaper, which pushed stock prices higher and lowered yields on government bonds.

This development was welcomed by businesses, homeowners, and investors, as many people across the country have been struggling with higher interest rates over the last two years. Powell’s cautious but open statement about a rate cut created a ripple of optimism, sparking movements across Wall Street and financial markets worldwide.

A Market Hungry for Relief

For months, the Federal Reserve has kept interest rates high to control inflation. Higher rates make borrowing more expensive for businesses and families, but they also help slow down rising prices. However, inflation has cooled in recent months, and job growth has slowed, giving the Fed more space to consider lowering rates.

On the day of Powell’s remarks, the Dow Jones Industrial Average which tracks 30 major American companies, surged over 500 points. The S&P 500 a broader measure of the market, also climbed sharply, while the Nasdaq Composite which is heavily influenced by technology companies, jumped even higher.

Bond markets also reacted. The yield on the 10-year US Treasury note which is a key indicator of long-term borrowing costs, fell noticeably. When investors expect rate cuts, bond yields usually fall because future returns are likely to be lower.

What Powell Actually Said

Powell did not directly confirm a September rate cut, but he clearly left the possibility open. Speaking at an economic symposium, he said the central bank will carefully evaluate the data in the coming weeks and make decisions that balance inflation risks with the health of the job market.

His comments carried a softer tone than in previous months when he often emphasised the need to keep rates high until inflation was fully under control. This shift was enough for markets to believe that a rate cut in September is now more likely than ever.

Powell also noted that inflation, while still above the Federal Reserve’s target of 2%, has been moving in the right direction. At the same time, he acknowledged that keeping rates too high for too long could slow down the economy too much, hurting businesses and jobs.

Why This Matters for Ordinary People

While market movements a bond yields may sound far removed from daily life, Powell’s remarks could affect millions of Americans in the coming months.

For Homebuyers: Mortgage rates are currently high, making it harder for families to afford homes. A rate cut could bring down mortgage costs.

For Credit Card Users: People carrying credit card debt are paying record-high interest rates. Lower rates would ease this burden.

For Businesses: Companies that need loans to expand or invest are eagerly waiting for cheaper borrowing costs. A cut could encourage growth.

For Workers: Lower rates can help businesses hire more and keep the job market stronger.

In short, Powell’s hint at a September cut brought hope to both Wall Street and Main Street.

The Inflation Puzzle

The main reason the Fed raised rates aggressively over the past two years was to fight inflation, which had surged to the highest levels in four decades. Prices of food, rent, gas, and other essentials had been rising quickly, hurting families across the country.

Now, with inflation cooling, the Fed faces a balancing act. If it cuts rates too soon, inflation could rise again. But if it waits too long, the economy could slide toward recession. Powell’s message suggests the central bank believes it may now be safe to start easing rates.

Recent reports show that consumer prices have slowed and wage growth has also moderated. These signs strengthen the case for rate cuts.

Global Reactions

Markets outside the United States also responded positively. European and Asian stocks rose as investors bet that a Fed rate cut would support global growth.

Currencies also shifted. The US dollar weakened slightly against other major currencies because lower interest rates often reduce the appeal of holding dollars. A weaker dollar, however, can help American exporters by making their goods cheaper abroad.

Oil prices rose too, partly because a stronger global economy usually leads to higher demand for energy.

Wall Street Bets on September

Investors are now overwhelmingly betting that the Federal Reserve will announce a rate cut at its September meeting. Futures markets, where traders place bets on interest rate moves, show a strong expectation of at least a quarter-point cut. Some even think the Fed might cut more than once before the year ends.

Still, Powell and other Fed officials have been careful not to make firm promises. They want to see more economic data before taking action. Upcoming reports on inflation, jobs, and consumer spending will play a big role in the final decision.

Lessons from the Past

The Federal Reserve has been through similar situations before. In past decades, it sometimes cut rates too early, only to see inflation return. Other times, it waited too long and pushed the economy into recession.

This history explains why Powell is cautious. He does not want to risk undoing progress on inflation, but he also does not want to damage the economy by keeping rates high unnecessarily.

The Bigger Picture

The possible September rate cut is not just about economics; it is also about politics and public confidence. With a presidential election season underway, Americans are paying close attention to the cost of living and job security.

While the Fed is independent and does not act based on politics, its decisions affect millions of households. Lower rates could improve consumer confidence, giving families some relief after years of high inflation.

What Happens Next

The Federal Reserve’s next policy meeting is in mid-September. Until then, analysts, investors, and ordinary citizens will be watching every new piece of economic data closely.

If inflation continues to cool and the job market shows signs of slowing, a September rate cut looks very likely. But if prices unexpectedly rise again, the Fed could delay the move.

Either way, Powell’s remarks have already changed the tone of the conversation. The idea of rate cuts, once distant, now feels within reach.

The financial world celebrated after Powell opened the door to a possible September interest rate cut. Stocks soared, bond yields dropped, and optimism returned to markets.

For businesses, families, and workers, this could mean easier borrowing, more investment, and greater stability. For the Federal Reserve, it marks a delicate turning point as it tries to balance the fight against inflation with the need to keep the economy strong.

Stay informed with the latest news. Follow DXB News Network on WhatsApp Channel

The coming weeks will decide whether Powell’s cautious words turn into action, but for now, Wall Street and beyond are filled with renewed hope.

PM Modi Lays ₹6,300 Crore Projects in Assam Criticizes Congress

PM Modi accuses Congress of backing infiltrators lays ₹6,300 crore health and infrastructure project

Nepal President Dissolves Parliament Parties Call Move Unconstitutional

Nepal’s President dissolves Parliament, sparking criticism from major political parties and lawyers

Turkey fears becoming next target after Israel strike

Turkey warns Israel may expand attacks after strike on Hamas in Qatar. Tensions rise as Erdogan stre

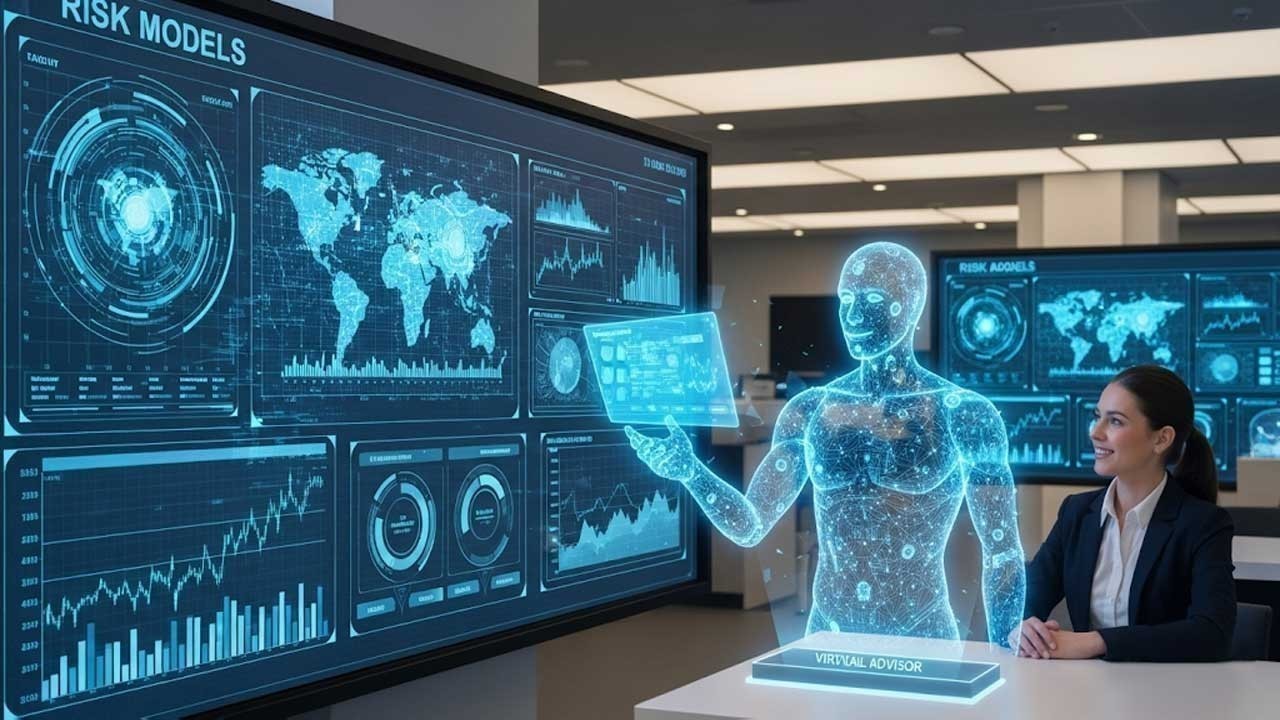

How AI Is Transforming Banking From Smarter Risk Models to Virtual Financial Advisors

Explore how AI is reshaping banking with smarter risk models virtual advisors personalized service

Fatal Shooting of Conservative Activist in Utah College

Authorities investigate Utah college shooting that killed activist Charlie Kirk. Suspect arrested fa

MBZUAI Leads UAE’s Global AI Ambitions with New Student Programs

UAE’s MBZUAI advances AI education with new undergraduate, graduate programs and research shaping na

4.9 Magnitude Earthquake Strikes Near Sinabang Indonesia

A shallow 4.9 earthquake shakes western Sinabang Indonesia. Authorities report no major damage but w

How AI Is Transforming Banking From Smarter Risk Models to Virtual Financial Advisors

Explore how AI is reshaping banking with smarter risk models virtual advisors personalized service

From $6.5 Trillion to $7.5 Trillion The New Era of Global Banking Growth

Global banking revenues set to rise from $6.5T in 2023 to $7.5T by 2027 driven by digital growth i

Global Banking 2025 A New Era of Technology Trust and Transformation

Discover how global banking in 2025 is being transformed by AI digital finance green banking and

Alibaba Unveils Smaller AI Model Matching Larger Ones Efficiently

Alibaba launches a new AI model that is smaller, faster, and cheaper but performs as well as larger

Fujairah Hosts Sixth Round of Khaled Bin Mohamed Jiu-Jitsu Championship

Over 1,600 young athletes compete in Fujairah as Baniyas Club tops rankings at the sixth round of Kh

UAE Tops Global Competitiveness Rankings and Shows Strong Growth

UAE ranks among the world’s top nations in competitiveness, innovation, health, and safety, leading

UAE rowers win silver and bronze at Asian Beach Sprint Finals

UAE rowing team wins silver and bronze at the Asian Rowing Beach Sprint Finals 2025 in China marking

UN chief condemns Haiti gang attack that killed over 40 people

UN chief denounces brutal gang attack in Haiti killing 40 calls for urgent global support to help re