Post by : Zayd Kamal

The Rise of Fintech: Transforming the Way We Handle Money

Technology has transformed every aspect of our lives, and the financial sector is no exception. Over the past decade, How Fintech is Changing Finance and Making Money Management Easy has become a major topic of discussion. Financial technology, or fintech, is revolutionizing banking, payments, investments, and budgeting, making money management more accessible and efficient for people worldwide. From mobile banking apps to artificial intelligence-powered investment platforms, fintech is reshaping how individuals and businesses handle their finances.

The Evolution of Fintech and Its Growing Impact

The term "fintech" refers to the integration of technology into financial services to enhance efficiency, security, and convenience. How Fintech is Changing Finance and Making Money Management Easy can be seen in various areas such as digital wallets, online lending platforms, and automated budgeting tools. Traditional banking methods required in-person visits and manual paperwork, but fintech has made financial transactions quicker and simpler. Companies like PayPal, Venmo, and Apple Pay have eliminated the need for physical cash, allowing users to make transactions with just a few clicks.

Digital Banking: Banking Made Simple and Accessible

One of the biggest transformations in How Fintech is Changing Finance and Making Money Management Easy is digital banking. Mobile banking apps now allow customers to transfer money, check balances, and even apply for loans without visiting a physical bank. Many fintech startups are also offering online-only banking services, which provide lower fees and higher interest rates compared to traditional banks. With the rise of neobanks, like Revolut and Chime, customers enjoy seamless, paperless banking experiences tailored to modern financial needs.

Fintech and Smart Investments: AI-Powered Wealth Management

Investing was once limited to those who had access to professional financial advisors. Today, How Fintech is Changing Finance and Making Money Management Easy is evident in AI-driven investment platforms such as Robinhood, Betterment, and Wealthfront. These robo-advisors analyze market trends and provide users with tailored investment strategies. Fintech has lowered the barriers to entry, allowing anyone—regardless of financial knowledge—to start investing with minimal effort. Additionally, cryptocurrency trading apps like Binance and Coinbase have introduced new opportunities for digital asset investment.

Budgeting and Expense Tracking: Managing Money Effortlessly

Another significant way How Fintech is Changing Finance and Making Money Management Easy is through budgeting and expense-tracking applications. Apps like Mint, YNAB (You Need a Budget), and PocketGuard provide users with real-time insights into their spending habits. These apps categorize expenses, set savings goals, and alert users when they exceed their budgets. By using AI-powered analytics, fintech has helped individuals take control of their finances without needing expert financial knowledge.

Fintech in Lending: Easier Access to Loans and Credit

Getting a loan from traditional banks often requires lengthy paperwork and strict approval processes. However, How Fintech is Changing Finance and Making Money Management Easy can be seen in online lending platforms like SoFi and LendingClub, which offer quick, hassle-free loan approvals. These fintech lenders use artificial intelligence to assess borrowers' creditworthiness based on alternative data, making it easier for individuals with limited credit history to access funds. Fintech has also introduced "buy now, pay later" (BNPL) services like Klarna and Afterpay, allowing consumers to make purchases and pay in installments without high-interest credit cards.

Summary

How Fintech is Changing Finance and Making Money Management Easy explores the impact of financial technology on modern banking, investments, and budgeting. The article highlights how fintech innovations like digital banking, AI-powered investment platforms, and expense-tracking apps are making money management more accessible and efficient. It also discusses how fintech has revolutionized lending, providing quick access to credit without the hassles of traditional banks. With continuous advancements in blockchain, biometric payments, and AI-driven financial planning, fintech is shaping a future where financial services are more convenient, secure, and user-friendly.

Disclaimer

This article is for informational purposes only. The content provided does not constitute financial advice, investment recommendations, or professional consultation. Readers are encouraged to conduct their own research and consult with financial experts before making any financial decisions. DXB News Network is not responsible for any financial losses or decisions made based on the information in this article.

UAE Honours Global Peacebuilders at 2026 Zayed Award Ceremony

UAE President Sheikh Mohamed bin Zayed honours global peacebuilders, including Aliyev, Pashinyan, an

Shell Q4 Profit Drops 11% but Maintains Big Share Buybacks

Shell’s Q4 net profit fell to $3.3B amid weak oil and chemical markets, yet the company keeps strong

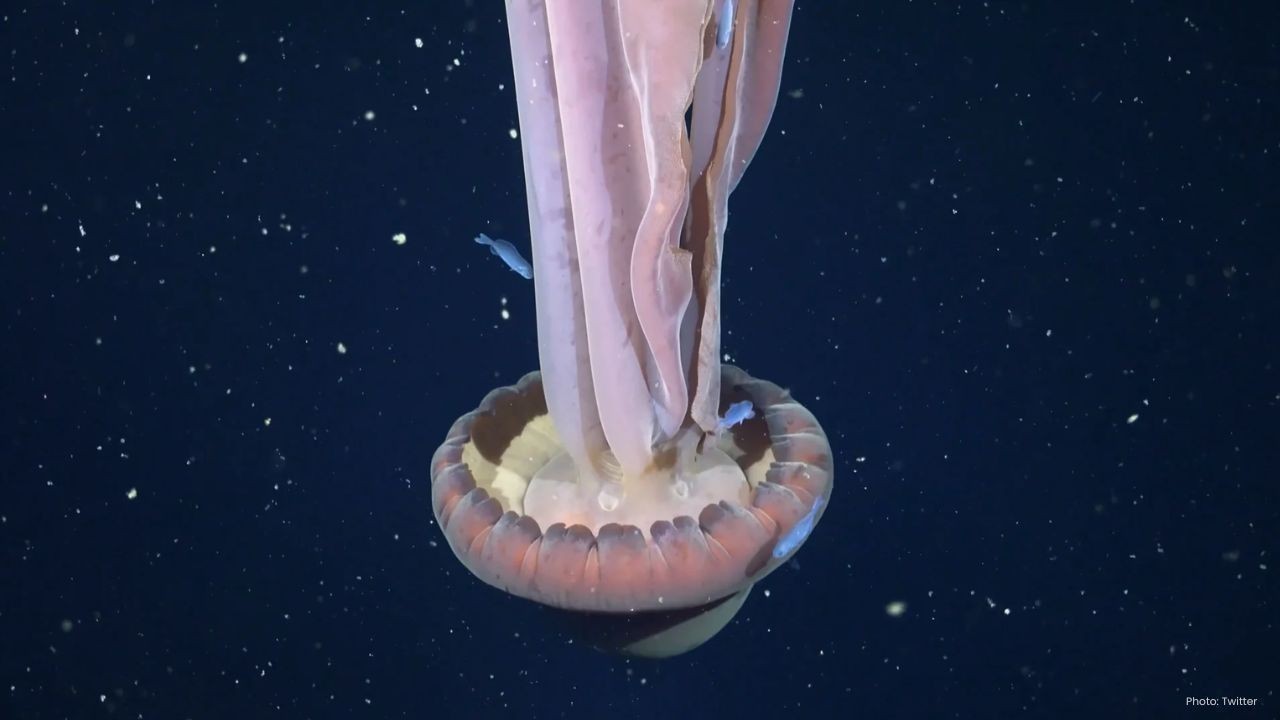

Rare Giant Phantom Jellyfish Spotted Off Argentina Coast

Scientists filmed the rare giant phantom jellyfish at 250m depth off Argentina. Only 126 sightings h

Russia Hits Ukraine Power Grid With Record Missile Barrage

Russia launched 450 drones and 70 missiles on Ukraine, targeting the power grid during extreme cold.

New START Treaty Ends, Removing Caps on US-Russia Nukes

New START expires Thursday, ending limits on US and Russian nuclear weapons. Russia regrets it, whil

Sanad, Rolls-Royce Expand Trent 700 MRO Deal to 2031

Sanad and Rolls-Royce expanded their Trent 700 MRO partnership at Singapore Airshow 2025, covering u

UAE OT Security First Forum Boosts Energy Infrastructure Defence

Under UAE Cyber Security Council patronage, OT Security First Forum gathered leaders to strengthen O

Winter Skin Care: 10 Hydrating Drinks That Give Natural Glass Skin Glow

Learn how simple winter drinks keep your skin hydrated reduce dryness and support a natural glass sk

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin