Post by : Sam Jeet Rahman

Inflation represents a major economic hurdle for businesses in 2025. Escalating costs of raw materials, labor, and transportation are squeezing profit margins and challenging even the most resilient enterprises.

For small and medium-sized businesses (SMEs), navigating inflation may seem intimidating. However, implementing effective financial strategies, wise pricing models, and operational efficiencies can help your business not only navigate inflation but emerge stronger.

This guide will dissect inflation's effects on businesses and offer practical actions to shield your operations, profits, and sustainable growth.

Inflation denotes the general rise in prices over time, implying that the same amount of money purchases fewer goods and services.

In 2025, inflation rates are fluctuating due to:

Global supply chain issues

Elevated energy and raw material expenses

Wage inflation pressures

Geopolitical instability and currency swings

The impacts of inflation on businesses include:

Operating expenses: Costs for raw materials, utilities, rentals, and labor continue to rise.

Consumer expenditures: Customers may reduce non-essential spending.

Profitability: If costs escalate quicker than revenues, profit margins diminish.

Cash flow: Payment delays and rising costs challenge liquidity.

Grasping these elements enables you to foresee risks and strategize effectively.

One effective way to mitigate inflation's effects is by refreshing your pricing strategy — carefully, to avoid alienating customers.

Incremental price increases: Gradually raise prices rather than implementing abrupt hikes.

Value-oriented pricing: Emphasize the value perception of your offering as opposed to just cost-based pricing.

Bundle products and services: Create combined offers to boost the average transaction value.

Introduce premium alternatives: Offer higher-end products to attract less price-sensitive customers.

Transparent communication: Inform customers about the reasons behind price adjustments — building trust is key.

Example:

A café facing surging coffee bean costs could introduce combo deals (coffee + pastry) rather than a simple price increase for coffee. This way, loyalty is preserved alongside improved margins.

Inflation can reveal inefficiencies within business operations. It’s crucial to scrutinize your spending and eliminate waste.

Expense monitoring: Identify recurring costs eligible for reduction or renegotiation.

Outsource auxiliary functions: Delegate services like payroll or marketing to external experts to minimize in-house expenses.

Automation investments: Employ software for inventory, billing, and customer relations to save time and labor.

Cut energy use: Transition to energy-efficient appliances and adopt sustainable practices.

Supplier negotiations: Leverage long-term contracts or bulk buying for favorable terms.

Enhancing efficiency makes your business more resilient against economic fluctuations.

Dependence on a single product, service, or customer segment can jeopardize your business during inflationary phases.

New product offerings: Diversify into related products or services.

New market exploration: Consider exporting or entering online sales to reach global consumers.

Digital service provisions: Create subscriptions or online revenue models where applicable.

Partnerships with complementary brands: Collaborate with related businesses to share costs and expand market access.

Example:

A gym could start offering virtual classes or health supplements, ensuring revenue remains steady, even if physical attendance decreases.

Inflation may erode your cash's purchasing power. It's essential for businesses to bolster liquidity and secure consistent cash inflows.

Timely invoicing: Avoid delaying client bills. Automate invoicing to speed up collections.

Incentivize early payments: Offer discounts to motivate prompt client payments.

Emergency funds: Maintain reserves for at least 3–6 months of operating costs.

Review credit terms: Shorten payment cycles wherever possible.

Inflation-hedged investments: Consider safe instruments that keep pace with inflation.

Cash flow is vital for your business; safeguarding it ensures stability amidst economic turbulence.

Inflation influences your entire supply chain. Establishing strong relationships can provide leverage during negotiations.

Long-term contracts: Lock in pricing before further increases.

Multiple suppliers: Eliminate reliance on a single vendor.

Fostering collaboration: Share forecasts and work jointly to reduce costs.

Strategic bulk purchases: Stock up on essential materials before costs rise.

Strong supplier relations offer consistency and protect against price volatility.

In times of inflation, customer retention proves more cost-efficient than acquiring new clients.

Loyalty incentives: Reward repeat customers with exclusive discounts or offers.

Personalized outreach: Engage customers using email and SMS to maintain interest.

Highlighting value: Clearly communicate why your product or service holds value.

Upselling and cross-selling: Encourage complementary purchases to increase transaction size.

Example:

A fashion brand could run “Buy More, Save More” campaigns—boosting sales volume while aiding customers’ affordability.

Digital transformation stands as a powerful shield against inflation. Automation, data analytics, and AI can streamline processes and cut costs.

Cloud-based financial tools for real-time expense tracking.

Inventory management solutions to avoid overstocking or wastefulness.

AI analytics to forecast demand and inform purchasing decisions.

CRM systems to enhance customer service and loyalty.

Businesses investing in technology today will remain adaptive, competitive, and economical moving forward.

During inflation, wage increases are common, and retaining talent becomes essential. Instead of uniform salary boosts, focus on intelligent compensation structures.

Provide merit-based bonuses rather than flat raises.

Introduce flexible perks (remote work, wellness initiatives, additional paid time off).

Offer skills development programs to enhance productivity.

Maintain transparency regarding business conditions—openness fosters loyalty.

Employees who feel valued and engaged are more productive, helping your business flourish in challenging times.

Smart companies use financial hedging methods to shield themselves from inflation and currency fluctuations.

Commodities and futures contracts: Secure raw material pricing in advance.

Investments in real estate: Property values typically appreciate during inflation.

Treasury Inflation-Protected Securities (TIPS): Safeguard cash reserves against devaluation.

Diversifying currencies: Mitigate domestic inflation risks.

Consult a financial expert to customize hedging strategies per your business scale and sector.

Inflation is inherently cyclical — it will rise and fall. The priority for your business is to adapt, innovate, and remain flexible.

Keep debt levels in check.

Nurture customer relationships.

Invest continuously in brand visibility and excellence.

Welcome innovation and adopt sustainable business practices.

Businesses that adapt effectively during inflationary cycles often become more efficient and competitive in the longer term.

Inflation need not spell disaster for businesses — it can instead be a catalyst for growth, innovation, and strategic planning. By assessing costs, optimizing pricing, diversifying revenue streams, investing in technology, and managing cash flow, you can fortify your business against inflation in 2025 and beyond.

The crux is to act decisively, maintain flexibility, and base decisions on data. Businesses willing to adapt now will not only weather inflation but also build a foundation for enduring success and financial freedom.

Advocate Sheela Thomas — Where Leadership Meets Compassion

Advocate Sheela Thomas — UAE lawyer, humanitarian, and CEO of Najmah Group, empowering lives through

King Charles Prays with Pope, Historic Anglican-Catholic Moment

King Charles III prays with Pope Leo XIV at the Vatican, marking first public joint prayer since Eng

UAE Leaders Congratulate Sanae Takaichi on Japan PM Win

UAE leaders extend congratulations to Sanae Takaichi on her election as Japan's Prime Minister, high

Google Skills Launches to Boost AI & Tech Learning Globally

Google unveils Google Skills, offering 3,000 AI & tech courses, labs, and certifications to empower

DP World Launches £170M High-Tech Container Hub in UK

DP World invests £170M in London Gateway, introducing BOXBAY Empty Superstack to boost container sto

Lina Ahmed – Women in Tech: Bridging Innovation, Purpose, and Progress

Meet Lina Ahmed, a visionary entrepreneur and wellness advocate inspiring women in the UAE through c

OPEC Fund Fuels Growth in Armenia's MSME Sector

The OPEC Fund's $30M loan for Evocabank strengthens Armenia's MSMEs and climate investments, fosteri

Why Eating Before Sunset Can Transform Your Health Naturally

Discover why eating before sunset improves digestion boosts energy and supports better sleep for a h

Gyokeres Sets Sights on Premier League After Stellar Win

Following Arsenal's emphatic 4-0 victory, Viktor Gyokeres aims to keep scoring in the Premier League

Liverpool, Chelsea, and Bayern Excel in Champions League Showdowns

Liverpool, Chelsea, and Bayern Munich showcased impressive wins in the Champions League, while Real

Stormy Weather Cancels New Zealand vs England T20 Face-off

A heavy downpour in Auckland led to the early abandonment of the New Zealand vs England T20 match, l

Proteas Overcome Pakistan to Even Test Series

In Rawalpindi, South Africa defeated Pakistan by eight wickets, evening the Test series. Harmer shon

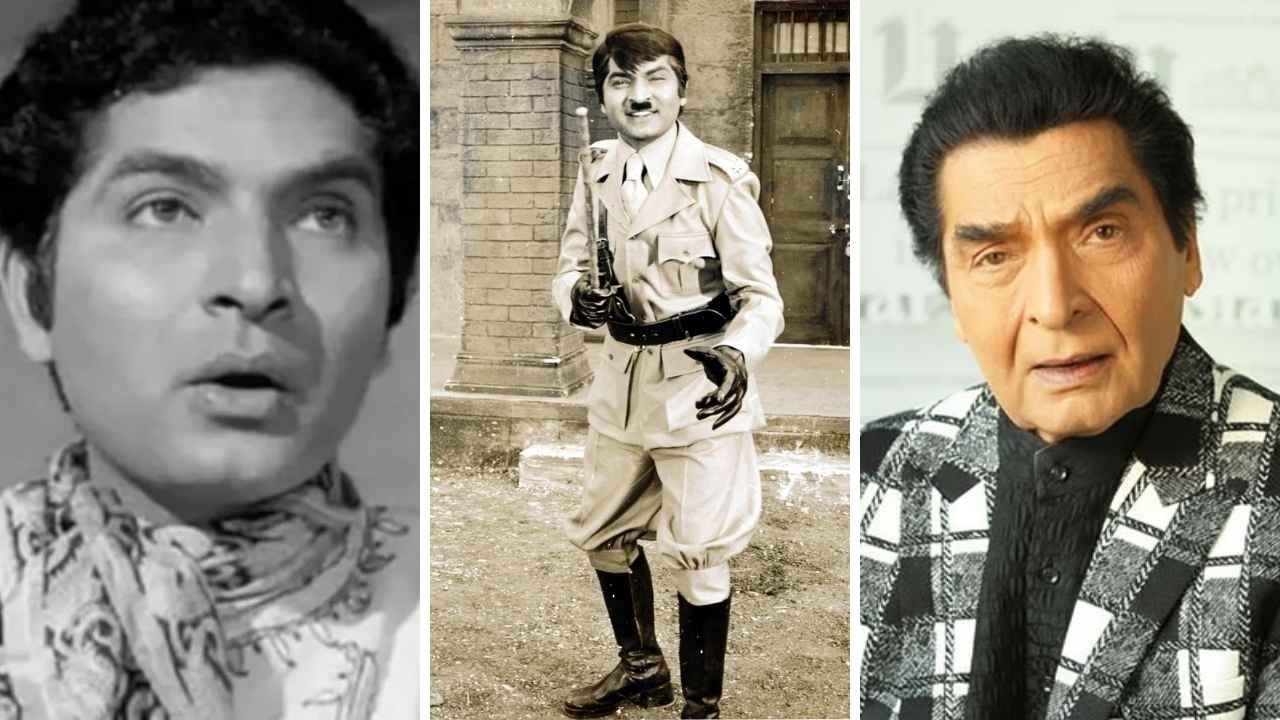

84 Asrani Passes Away Bollywood Remembers Its Comedy Legend

Bollywood legend Asrani passes away at 84 leaving behind a legacy of laughter iconic roles and unfor

Breast Cancer Awareness Month Early Detection Prevention and Support

Learn about Breast Cancer Awareness Month early detection prevention tips and ways to support patien

The Best Time to Take Your Vitamins for Maximum Health Benefits

Discover the best time to take vitamins for energy immunity and absorption Maximize health benefits