Post by : Naveen Mittal

Moving to the UAE as an expatriate offers world-class opportunities, including access to exceptional healthcare. However, navigating the mandatory insurance requirements and understanding the actual costs is essential for a smooth transition. This guide breaks down what you need to know about healthcare costs and the crucial new mandatory regulations taking effect in 2025.

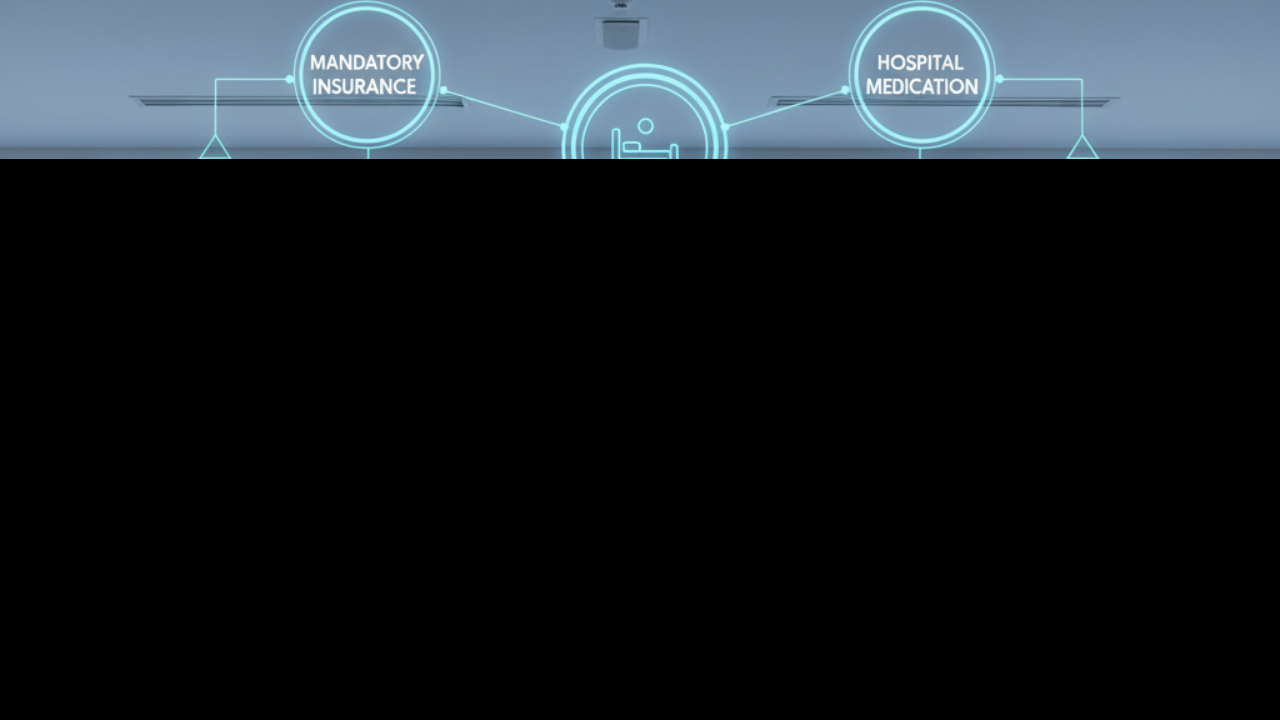

The most significant change in the UAE's healthcare landscape is the expansion of mandatory employer-provided health insurance across all seven Emirates starting from January 1, 2025. Previously limited primarily to Dubai and Abu Dhabi, this federal mandate ensures universal basic coverage for all private-sector employees and domestic workers.

Employer Obligation: All employers are now legally required to provide at least a basic level of health insurance to their staff as a prerequisite for issuing or renewing a residency permit.

The Basic Package: A government-sponsored basic insurance policy, such as the new nationwide package priced competitively around AED 320 per year, is available. This ensures low-income workers and dependents receive essential care. Crucially, this basic plan offers coverage for chronic diseases and pre-existing conditions without a waiting period.

Dependent Responsibility: While the employer must cover the employee, in most cases, expats remain responsible for purchasing health insurance for their family members (spouse, children, and parents). This is a critical factor to include in your annual budget.

The cost of your health insurance will vary significantly based on your needs, but you can expect premiums to fall into distinct tiers:

Basic Coverage (Essential Benefits): These plans are designed to meet the mandatory legal minimum, with prices typically ranging from AED 500 to AED 1,500 annually. They have limited network access and generally involve higher co-payments for services.

Mid-Range Plans: These plans are the most common choice for general expats, offering broader access to specialists and a wider network of hospitals and clinics (both local and regional). Premiums usually fall between AED 3,000 and AED 7,000 per year. They include better coverage for inpatient and outpatient care.

Premium/Comprehensive Plans: For those seeking the highest level of care, including access to top-tier private hospitals, worldwide emergency coverage, and benefits like dental, optical, or comprehensive maternity care, annual premiums start from AED 8,000 and can exceed AED 20,000.

Family Cost: If you are insuring a family of four, you should budget for annual costs that range from AED 17,000 to AED 33,500 for a comprehensive family plan.

While the UAE boasts excellent public hospitals, the healthcare system is structured such that expatriates primarily rely on the private sector.

Public System Access: Expats can access public facilities, but they must first obtain an annual Health Card (for a small fee) and still pay subsidized fees. The public system is primarily subsidized for UAE nationals.

Private Sector Preference: The vast majority of expats choose private healthcare due to its numerous advantages: minimal waiting times, a greater number of multilingual staff, the latest medical technology, and a higher general standard of luxury and comfort.

Out-of-Pocket Costs: Without a robust insurance plan, the costs of private care are substantial. A general practitioner consultation can cost between AED 300 and AED 500, while an emergency room visit may cost AED 500 to AED 1,500. A single hospital stay or surgery can quickly result in a bill that far surpasses the cost of your annual premium.

A critical factor affecting your budget is the high rate of medical inflation in the UAE, which often outpaces the global average.

Premium Hikes: Medical costs and claims are rising, forcing insurance providers to increase premiums. In recent years, premium hikes have been observed from 8% to over 25% for some international and comprehensive policies.

Causes of Inflation: This escalation is driven by several factors, including the high cost of imported medical technology and pharmaceuticals, the profit-driven structure of many private healthcare providers, and high utilization of services.

The Result: You must factor in annual premium increases when budgeting, and understand that a cheaper policy often translates to a much higher co-payment (your portion of the cost, sometimes up to 30%) or a higher deductible (the amount you pay before the insurance starts covering costs).

To manage your healthcare budget effectively, follow these key steps:

Review the EBP: Understand the exact limitations of your employer's Essential Benefits Plan (EBP). It is the minimum, not necessarily the best fit for your needs.

Prioritize Dependent Coverage: Secure a dedicated policy for your family, as this is your legal responsibility. Use a comparison platform to evaluate plans based on network and co-payment limits, not just the premium price.

Check for Exclusions: If you need services like maternity, dental, or vision care, confirm they are explicitly included. They are often optional riders or completely excluded from basic plans.

Factor in the Unexpected: Even with insurance, you will have out-of-pocket expenses via co-payments and deductibles. Have an emergency fund dedicated to unexpected medical costs.

Disclaimer: This article provides general financial guidance based on current UAE regulations and market trends for expatriates. Healthcare costs and insurance laws are subject to change. Always consult with a licensed insurance provider and relevant governmental authorities in the specific Emirate (e.g., DHA in Dubai, DoH in Abu Dhabi) to confirm current legal requirements and obtain personalised advice before making any financial or medical decisions.

Easy Healthcare Access in UAE Through Top Pharmacies & Apps

Explore the best pharmacies and health apps in UAE 2025. Get medications, book appointments, and acc

Navigating UAE Healthcare Costs: An Essential Financial Guide for Expats

Planning a move to the UAE? Learn to navigate the mandatory health insurance, private vs public hosp

Crucial Updates to Medical Fitness Tests for All New and Renewing UAE Residents

Planning your move to the UAE in 2025? Get the latest on mandatory medical fitness tests, required v

Finding Your Support: A 2025 Guide to Top Mental Health Therapists and Clinics in the UAE

Navigate mental wellness in the UAE for 2025. Discover highly-rated clinics, expert psychologists, a

The Ultimate UAE Heat Survival Guide: 10 Essential Hydration and Lifestyle Secrets

Master the UAE’s hot climate with these 10 proven, human-written hydration and lifestyle tips. Learn

Find Affordable Healthcare Options in Dubai & Sharjah Without Compromising Quality

Discover budget-friendly clinics in Dubai and Sharjah for expats. Get quality healthcare at affordab

Discover the Most Popular Fitness Trends Expats and Locals Are Following in UAE

Explore top fitness trends in UAE 2025 including gyms, yoga, CrossFit, and wellness activities. Stay

Effective Ways to Reduce Joint Pain and Stiffness This Winter

Learn simple ways to reduce joint pain and stiffness this winter with warmth exercises diet tips and

Facial Sculpting and Non Invasive Techniques Safe Beauty Trends for the Future

Explore facial sculpting and non invasive techniques shaping beauty care Safe affordable and natural

Body Positivity Embracing Self Love Confidence & True Beauty

Celebrate body positivity embrace self love reject false beauty ideals and discover confidence at ev

Skin Microbiome Secrets to Healthy and Balanced Skin

Explore the skin microbiome its role in skin health and simple ways to keep your skin balanced healt

Sarcopenia How Aging Steals Muscle and Ways to Stay Strong

Discover sarcopenia the silent muscle loss with age its signs causes and simple ways to stay strong

Cultural Appropriation vs Appreciation Respecting Global Traditions

Learn the difference between cultural appropriation and appreciation to respect traditions and celeb

Uniform and Rebellion How Personal Identity Thrives Within Rules

Explore how uniforms shape identity and spark subtle rebellion blending conformity with personal exp

The Unseen Labor Behind Fashion Inside the Secret Stitch

Discover the hidden world of fashion labor and the secret stitch behind every garment Honor the hand