Post by : Anis Karim

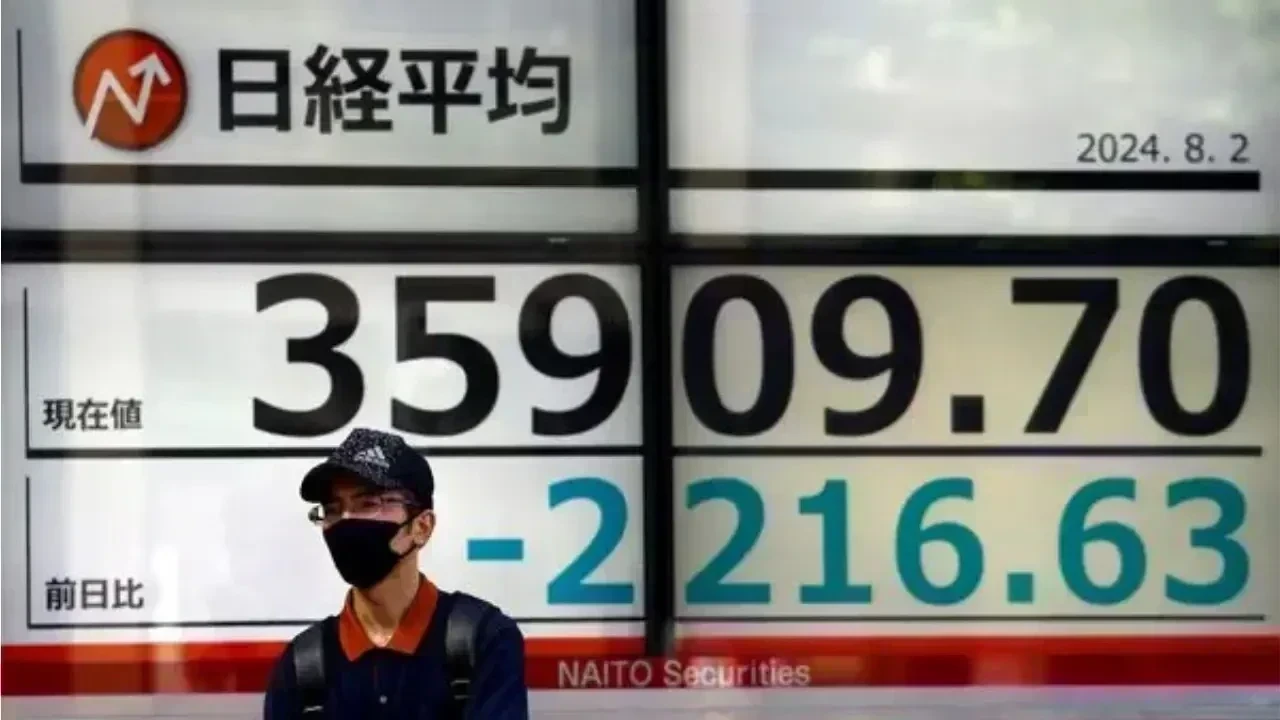

The Tokyo stock markets faced a substantial decline as pivotal indices closed notably lower, driven by a mix of domestic issues and global pressures that unsettled investor confidence. The Nikkei index dropped approximately 1.11 percent, while the broader Topix index also registered a decline, highlighting a concerning trend of losses across several trading sessions as the markets remained susceptible to adverse developments.

This downturn stemmed from alarming political developments that heightened market volatility, alongside anxieties regarding fiscal policies and escalating borrowing costs. Investors reacted quickly, weighing the potential impact on corporate earnings and the broader economic outlook in one of the world’s largest financial arenas.

The announcement of a snap general election set for February 8, 2026, by Prime Minister Sanae Takaichi served as the immediate spark for the market sell-off. The rise in political uncertainty deterred investors, who feared that the electoral process could invoke aggressive fiscal measures and elevate public spending, further straining Japan’s already considerable debt levels.

Japan’s debt-to-GDP ratio, among the highest globally, historically surpasses 250 percent. This prospect of increased fiscal expenditure without robust funding strategies is troubling for financial markets. The snap election, when coupled with potential policy adjustments, intensified worries about the future fiscal management of Japan.

An additional factor exacerbating the market turmoil was a sharp rise in the yields of Japanese government bonds, particularly at extended maturities. Yields on 40-year bonds approached 4 percent, marking the highest levels since 2007, emphasizing investor apprehensions about fiscal direction and bond sell-offs.

Increased long-term yields negatively affect stock markets in several respects: they elevate borrowing costs for businesses, diminish the present value of future profits, and often prompt a shift of investor portfolios from equities to fixed-income assets that offer more attractive returns.

The Nikkei average evidenced the sharpest downturn, impacted heavily by sectors particularly sensitive to financial conditions and global demand. The wider Topix index, incorporating a broader array of stocks including mid- and small-cap segments, also showed declines, suggesting that the downturn was pervasive rather than limited to specific sectors.

This widespread sell-off indicates that investors are responding not only to sector-specific risks but to broader systemic threats affecting Japan’s macroeconomic and corporate landscape.

Although recent data did not provide exhaustive details on sector performance, historically, sectors such as technology, consumer discretionary, and financials have shown increased responsiveness to escalating bond yields and fluctuations in economic policy perceptions. Higher borrowing costs, combined with political unpredictability, usually compress valuations for companies that depend on growth strategies and investment-driven expansion.

The weakness in Japanese equities is not isolated. Global markets are experiencing strain amid rising geopolitical tensions, including tariff threats from the U.S. and various concerns regarding trade relations with European partners. These international factors contribute to a risk-off climate, driving investors towards safer assets like gold and government bonds, while diminishing demand for equities.

Such cross-border implications exemplify the intertwined nature of global markets, where adverse developments in one major economy quickly influence sentiments and flows in others.

Japan’s historically low interest rates have made the yen carry trade—where investors borrow yen to invest in higher-yielding foreign assets—a common strategy. However, rising Japanese yields coupled with a depreciating yen may prompt unwinding of such trades, introducing additional volatility in equity and bond markets.

Significant fluctuations in this carry trade can impact global capital flows and asset valuations significantly, given the magnitude of assets linked to this strategy.

Prime Minister Sanae Takaichi aimed to consolidate support for her economic agenda, including fiscal initiatives like a food consumption tax reduction over two years, by calling a snap election. However, the markets are skeptical that while such tax cuts could stimulate the economy, they might also exacerbate fiscal gaps and increase governmental borrowing without sufficient measures to counterbalance.

Her leadership focuses on structural reforms and bolstering national economic resilience, yet investors remain wary of potential market disturbances as officials navigate the election landscape.

Snap elections typically introduce temporary uncertainty into financial arenas, with investors uncertain about possible shifts in policies and economic strategies. The closeness of the election relative to fiscal announcements has deepened fears surrounding future governmental expenditures and sustainability of debt, further compounding market jitters.

The Japanese long-term government bond market has been at the forefront of current volatility, with 30- and 40-year yields reaching multi-year or historic peaks. Investors have reacted to political shifts and fiscal expectations by seeking higher yields to balance risk, resulting in significant declines in bond prices.

Increased yields can ripple through the economy, affecting borrower costs for companies, refinancing expenses for the government, and influencing investor risk assessments. The behavior of the bond market frequently serves as a precursor to financial conditions, and in this instance, it has hinted at upcoming volatility in the equity space.

Disturbances in Japan’s bond market have implications that stretch internationally due to the dynamics of currency carry trades. As Japanese yields climb to levels competitive with, or exceeding those abroad, the motivations for borrowing in yen diminish. This change can lead to reduced capital inflows into foreign equities and bonds that were previously buoyed by this strategy, tightening global financial conditions.

Such reversals could exert increased pressure on global equities if risk assets lose a critical source of foreign investments.

Although the current downturn is significant, it is not the first occasion Japan has faced extensive market pressure. Historical instances—such as declines linked to global crises or periods of systemic financial strain—demonstrate that Japan’s markets can experience volatility when internal and external pressures converge. For instance, during the COVID-19 global downturn, Japanese equity indices witnessed sharp drops alongside worldwide markets, reflecting synchronized sell-offs.

However, today’s context includes distinct elements, such as a mix of political jitteriness, spikes in yield, and global risk-off attitudes, distinguishing this episode from more cyclical downturns in history.

In the short term, volatility is anticipated to persist in both Japanese equity and bond markets. With evolving political uncertainties and apprehensions regarding global growth, investors may shift towards defensiveness, reducing their risk exposure or seeking solace in safe-haven assets.

For those investing long term, this scenario underscores the necessity of grasping macroeconomic fundamentals and fiscal health. While market declines can offer buying prospects, they also highlight the risks associated with policy changes, demographic shifts, and dynamics of capital flows.

Japan’s demographic issues—including an aging populace and slow economic growth—continue to impact long-term economic outlooks and market valuations.

Currently, Japanese financial markets find themselves at a sensitive juncture, characterized by shifting political landscapes, rising bond yields, and global financial apprehension. The steep drop in equity indices reveals deep-rooted concerns around fiscal policy, investor confidence, and cross-border financial linkages. As the country enters an election phase with uncertain economic policy results, markets will remain highly responsive to both domestic developments and global economic signals.

Disclaimer:

This article draws on current market observations and publicly available information at the time of writing. Financial markets are inherently volatile, and it is advisable for readers to conduct personal research or consult professionals prior to making investment choices.

Winter Skin Care: 10 Hydrating Drinks That Give Natural Glass Skin Glow

Learn how simple winter drinks keep your skin hydrated reduce dryness and support a natural glass sk

10 Songs That Carry the Same Grit and Realness as Banda Kaam Ka by Chaar Diwari

From underground hip hop to introspective rap here are ten songs that carry the same gritty realisti

PPG and JAFZA Launch Major Tree-Planting Drive for Sustainability

PPG teams up with JAFZA to plant 500 native trees, enhancing green spaces, biodiversity, and air qua

Dubai Welcomes Russia’s Largest Plastic Surgery Team

Russia’s largest plastic surgery team launches a new hub at Fayy Health, bringing world-class aesthe

The Art of Negotiation

Negotiation is more than deal making. It is a life skill that shapes business success leadership dec

Hong Kong Dragon Boat Challenge 2026 Makes Global Debut in Dubai

Dubai successfully hosted the world’s first Hong Kong dragon boat races of 2026, blending sport, cul

Ghanem Launches Regulated Fractional Property Ownership in KSA

Ghanem introduces regulated fractional real estate ownership in Saudi Arabia under REGA Sandbox, ena

Winter Skin Care: 10 Hydrating Drinks That Give Natural Glass Skin Glow

Learn how simple winter drinks keep your skin hydrated reduce dryness and support a natural glass sk

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin