Post by : Soumya Jit

Oil prices remain the lifeblood of the Gulf Cooperation Council (GCC) economies. In 2025, the region continues to be shaped by the fluctuations of global crude markets, with both opportunities and risks emerging for countries like Saudi Arabia, the UAE, Qatar, Kuwait, Oman, and Bahrain. While these economies are actively pursuing diversification strategies under their national visions, hydrocarbons still account for a significant share of fiscal revenue, trade balances, and sovereign wealth inflows.

Understanding how global market dynamics influence oil prices in 2025 is essential for investors, policymakers, and citizens across the GCC.

Oil prices in 2025 are being shaped by a mix of supply, demand, and geopolitical factors:

OPEC+ Production Policies: The GCC plays a central role in OPEC+, with Saudi Arabia and the UAE leading production adjustments. Any decision to cut or increase output directly affects global benchmarks like Brent crude.

US Shale and Alternative Supply: The revival of US shale oil, coupled with Canadian and Brazilian exports, adds supply to the global market and influences price ceilings.

Demand from Asia: China and India remain the largest consumers of GCC crude. Slower growth in either market can soften demand, while rapid industrial recovery boosts prices.

Energy Transition Pressures: Renewables, EV adoption, and climate regulations are reducing long-term demand for fossil fuels, shaping oil market expectations and long-term contracts.

Geopolitical Conflicts: Tensions in the Middle East, Eastern Europe, or shipping chokepoints like the Strait of Hormuz can trigger price spikes.

Each GCC nation has a fiscal breakeven oil price—the price at which budget revenues balance government spending. For example:

Saudi Arabia requires moderately higher prices due to its expansive Vision 2030 investments and social spending.

The UAE benefits from more diversified revenue streams (tourism, trade, real estate), making it less vulnerable but still reliant on stable oil income.

Qatar has an advantage with its liquefied natural gas (LNG) exports, which provide a buffer against oil fluctuations.

Kuwait and Oman remain heavily reliant on crude, with budget health closely tied to Brent movements.

Bahrain faces the highest risk, as it has fewer reserves and smaller fiscal buffers compared to its neighbors.

Higher oil prices in 2025 support strong government spending, fiscal surpluses, and further accumulation in sovereign wealth funds. Lower prices, however, can trigger budget deficits, borrowing needs, and subsidy cuts.

Most GCC currencies are pegged to the US dollar. Oil price movements influence:

Foreign reserves: High oil revenues strengthen reserves, making pegs more secure.

Liquidity: Banks benefit from increased deposits during high-price cycles.

Inflation control: Higher oil prices globally increase import costs, but GCC governments often use subsidies to shield domestic consumers.

All GCC nations are actively working on economic diversification to reduce dependence on oil.

Saudi Arabia’s Vision 2030 includes mega projects like NEOM, tourism expansion, and manufacturing hubs, funded by oil revenues.

UAE’s Vision 2031 focuses on real estate, finance, trade, renewable energy, and technology to become a global hub beyond oil.

Qatar’s National Vision 2030 leverages LNG and infrastructure while boosting finance and sports sectors.

Kuwait, Oman, and Bahrain are investing in logistics, ports, and renewable energy to reduce oil reliance.

In 2025, strong oil prices accelerate diversification plans by financing large projects. However, low prices can delay non-oil investments.

Sovereign wealth funds (SWFs) like Saudi Arabia’s Public Investment Fund (PIF), Abu Dhabi’s Mubadala, and Qatar Investment Authority (QIA) continue to invest heavily in global assets. Their ability to expand portfolios depends directly on oil-driven fiscal surpluses.

When oil prices are high, SWFs increase foreign acquisitions, infrastructure investments, and venture capital exposure.

When oil prices fall, withdrawals may be needed to support domestic budgets.

This cycle directly links global market shifts with the GCC’s global financial footprint.

Paradoxically, higher oil revenues accelerate the GCC’s push into renewable energy. Saudi Arabia, the UAE, and Oman are funding large solar and wind projects. The UAE’s Masdar and Saudi’s ACWA Power are becoming global leaders in clean energy exports.

However, sustained low oil prices may slow these transitions, as governments prioritize fiscal stability over long-term renewable investments.

Employment opportunities in the GCC are tied to oil price cycles:

High prices lead to more government projects, infrastructure expansion, and private sector activity—creating jobs for locals and expatriates.

Low prices may result in hiring freezes, reduced expat demand, or delayed projects.

The real estate sector, especially in cities like Dubai, Riyadh, and Doha, thrives when oil revenues are high, as government-led spending trickles into construction, tourism, and retail. Similarly, consumer confidence and luxury spending in the GCC rise during high-price cycles.

In 2025, oil prices remain a critical determinant of GCC economic health, shaping everything from government budgets to job markets, real estate, and diversification strategies. While the Gulf states are working to secure their future beyond hydrocarbons, the global oil market continues to define their short- and medium-term prosperity.

How to Start a Business in 2025: Easy Step-by-Step Guide

Kickstart your entrepreneurial journey in 2025! Learn how to start a business with this easy step-by

Fibermaxxing: The New Nutrition Trend That Really Works

Discover Fibermaxxing, the latest nutrition trend boosting digestion, gut health, and overall wellne

Understanding Anxiety Disorders: Simple Guide to Causes, Symptoms, and Treatment

Learn about anxiety disorders in simple words. Discover causes, symptoms & treatments to manage ment

Bluesky Explained: What You Need to Know About the New X (Twitter) Alternative

Bluesky is the new social app competing with X (Twitter). Discover its features, how it works, and w

Saudi Minister Meets Chinese Firms on Mining Deals

Saudi Minister Bandar Alkhorayef meets Chinese mining firms in Beijing to boost investments in the K

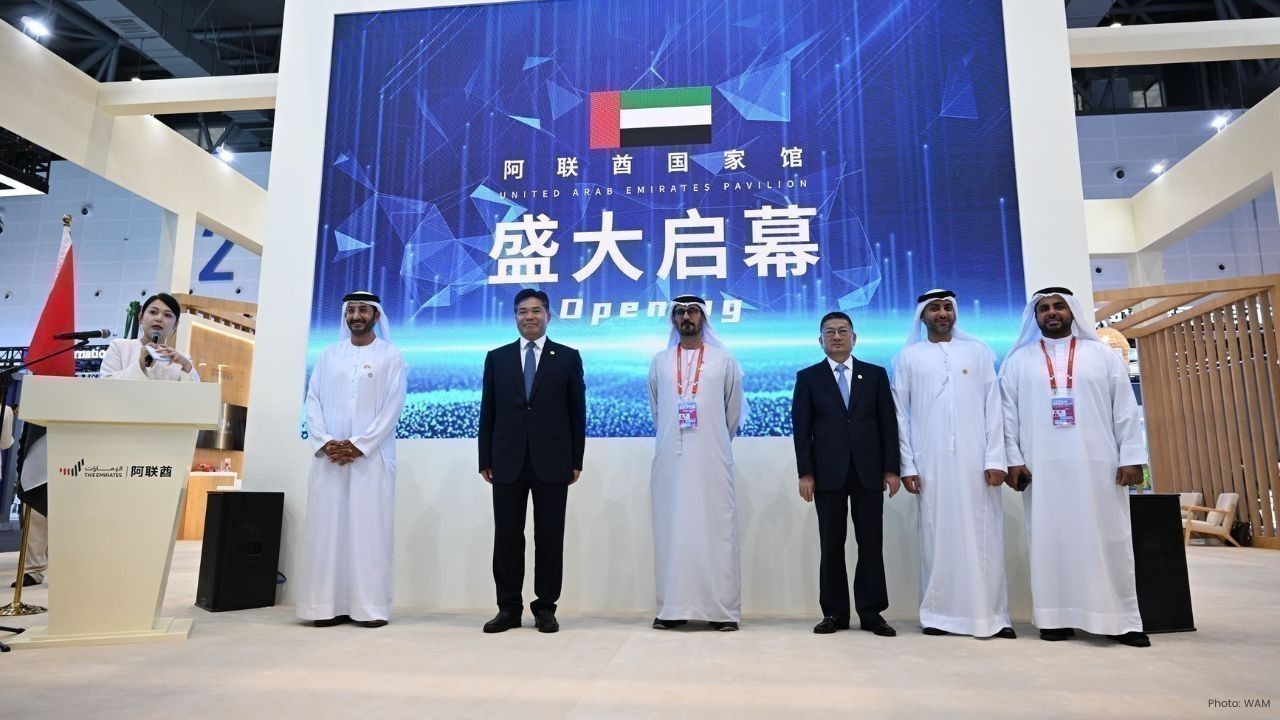

UAE Pavilion Debuts at Hangzhou Digital Trade Expo

UAE showcases digital economy innovations at Hangzhou Global Digital Trade Expo, strengthening China

Dubai Ranked Top 4 Global FinTech Hub in 2025

Dubai secures a top-four global FinTech ranking as DIFC hosts 1,500+ innovation firms, raising $4.2B

Fashion and Neuroscience How Clothing Shapes the Brain Emotions and Confidence

Discover how fashion and neuroscience connect Learn how clothing colors and style influence mood

Yoga for Kids Simple Poses and Healthy Habits for Young Minds

Discover easy yoga poses for kids to build healthy habits improve focus and boost physical and emo

Beauty as Self Regulation How Daily Grooming Boosts Mind Mood & Confidence

Discover how daily beauty and grooming routines help boost confidence calm the mind and improve em

Weight Loss Tips Simple Effective & Healthy Ways to Lose Weight

Discover simple and effective weight loss tips to stay healthy boost energy and maintain a balance

Environmental Exposomics How Daily Environmental Factors Affect Our Health

Discover how environmental exposomics reveals hidden daily exposures affecting our health lifestyle

Chrononutrition and Circadian Metabolism Why Meal Timing Shapes Better Health

Discover how chrononutrition and circadian metabolism improve digestion sleep energy and health b

The 5 Most Beautiful Jewels of Princess Diana Symbols of Love Style and Legacy

Explore Princess Diana s 5 most beautiful jewels from her sapphire ring to iconic tiaras each telli

8 Protein Powerhouses for Healthy Hair Growth Strong Shiny Hair Naturally

Boost hair growth naturally with 8 protein rich foods like eggs fish nuts and quinoa for stronger