Post by : Anis Karim

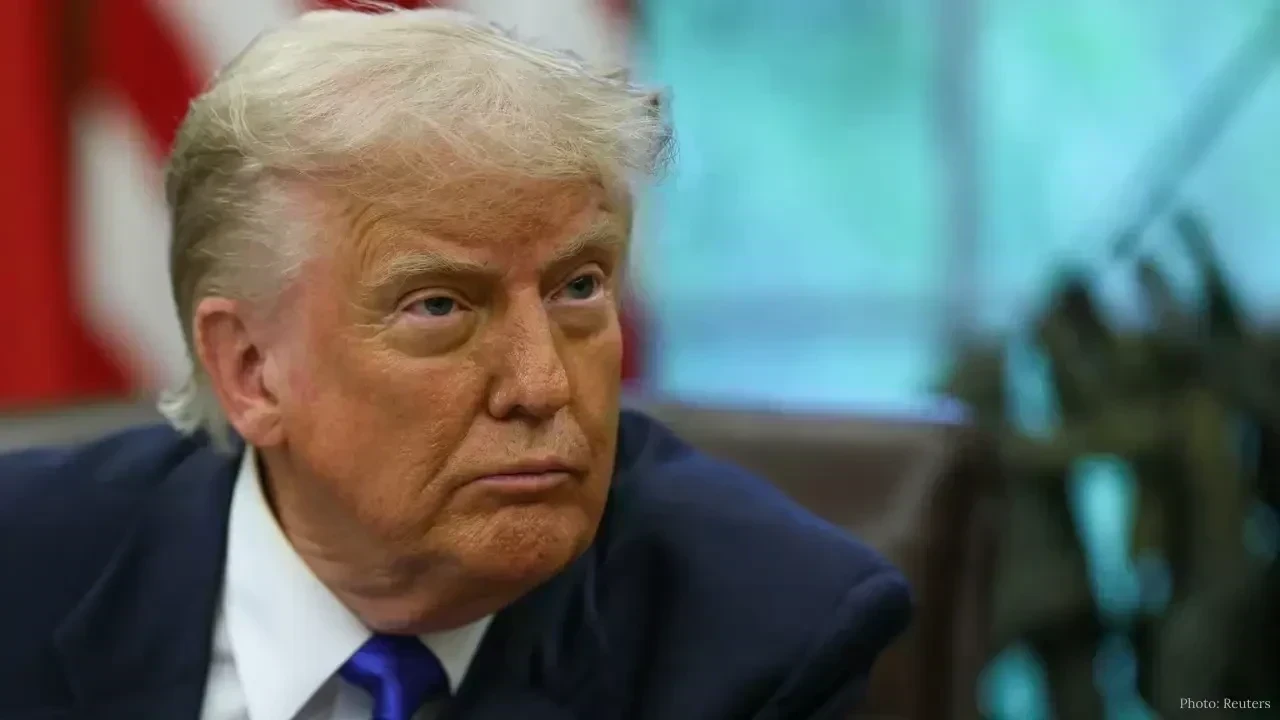

The stock markets in Dubai and globally are witnessing significant declines today. Key benchmarks, including the Dubai Financial Market General Index, are facing downward pressure, prompting investors to offload shares. Unlike an economic downturn or corporate setbacks, these declines are mainly attributed to escalating fears regarding trade tariffs and heightened political tensions, specifically concerning a recent tariff proposal associated with former U.S. President Donald Trump.

Tariffs are duties imposed on imported goods, and any abrupt changes in these rules can trigger negative responses in the stock markets. The current downturn reflects the substantial impact that investor fears—whether based on confirmed events or mere speculation—can have on market performance.

This article delves into the reasons behind today’s stock market decline, the interplay between global political dynamics and investor sentiment, the impact on export-driven sectors, as well as projections for the future.

At the heart of today’s market downturn is the announcement surrounding a potential tariff proposal championed by Donald Trump. This legislation could impose extraordinarily high import taxes—up to 500%—on Russian oil and products from countries conducting business with Russia.

The intention is to penalize nations that continue their imports of Russian oil. As the bill awaits legislative review, the ambiguity of future trade policies has investors on edge. The mere possibility of such extensive tariffs is unsettling to traders for several reasons:

Higher costs for imported and exported goods could burden companies.

Trade partners might retaliate with their own tariffs.

A potential slowdown in global trade could negatively impact corporate profits.

Such tariff apprehensions have resulted in intense selling across financial markets worldwide.

Investment professionals remember the ramifications of tariffs initiated during the Trump administration. For instance, in 2025, sweeping trade policies led to a notable global market downturn, exemplified by a drop in major indices such as the NASDAQ, Dow Jones, and S&P 500.

This historical backdrop contributes to today’s market jitters—traders recognize that trade policy shifts can suddenly alter risk assessments and economic growth forecasts.

In the Dubai market, indices have faced considerable losses amid escalating tariff concerns. Over the past several days, indices have significantly declined, erasing substantial investor value.

Globally, shares in the U.S., Asia, and Europe also display weakness, as traders tend to sell first and inquire later amidst rising geopolitical risks.

Foreign portfolio investors (FPIs) have been net sellers in the Dubai markets lately. The outflow paired with a stronger dollar typically signifies risk aversion, amplifying downward pressure on indices.

The concern that tariffs may hinder global growth leads international investors to avoid emerging markets, including equities in Dubai.

Export-driven firms are particularly vulnerable as tariff fears mount. Shares of local textile manufacturers and agricultural exporters have witnessed steep declines as traders factor in diminishing foreign demand and inflated operational expenses.

Such sectors are vital to the Dubai market, meaning the overall indices are negatively affected when these stocks tumble.

Increased tariffs elevate costs for goods crossing borders and can lead companies to pass these expenses onto consumers, thus squeezing profit margins and stalling economic activity.

Investors typically react preemptively to potential earnings downturns, leading to index-wide sell-offs.

The tariff discussions are a global concern that resonates far beyond Dubai. Traders in the U.S. and Asia are closely monitoring developments, recognizing that increased tariffs could adversely affect global GDP projections.

Additionally, markets are looking ahead to significant upcoming events, such as:

A U.S. jobs report that may shape Federal Reserve interest rate expectations.

A U.S. Supreme Court decision regarding tariff powers that could either ameliorate or exacerbate market concerns.

Many investors are currently factoring in both possible outcomes, leading to increased market volatility.

In financial markets, uncertainty drives selling pressures. Even if the tariff proposals do not pass, markets frequently react negatively in anticipation of adverse outcomes, demonstrating the phenomenon known as the anticipation effect.

The anxiety further heightens due to:

Potential tariffs being enacted via several legal avenues.

Targets on countries with extensive trading ties.

Indefinite timelines for enforcement.

These unknown factors leave traders feeling apprehensive.

Analyzing different sectors reveals varied responses:

Industries such as:

Textiles

Chemicals

Agricultural products

Seafood

have undergone intense selling. Should tariffs rise on exported goods to primary markets, it could drastically reduce international orders and, consequently, earnings.

Even large-cap companies—particularly in the metals, energy, and finance sectors—are feeling the pressure. Generally, these stocks provide market stability, but they are also experiencing declines due to the prevailing negative sentiment.

Investor aversion typically bolsters the U.S. dollar and bond yields as capital shifts from equities to safer assets. A stronger dollar makes imports cheaper for the U.S., yet exacerbates challenges for global equities, contributing to the weakness seen in commodity prices and emerging market currencies, including the Dirham.

Analysts characterize today’s downturn as a risk-averse response triggered by political and trade apprehensions rather than immediate corporate profit drops or shifts in consumer demands.

Some believe markets could overshoot downward before stabilizing, particularly if tariff news remains unfavorable. Conversely, favorable economic data or clarifications regarding tariffs could catalyze a swift market recovery, exemplifying the classic “sell the rumor, buy the fact” scenario.

Nevertheless, widespread anxiety results in cautious trading behavior and a focus on risk management.

For those attempting to navigate this market movement, key considerations include:

Anticipate larger price fluctuations as traders react to political and trade developments.

While short-term volatility might feel extreme, long-term investment strategies should be driven by fundamentals like cash flow and earnings, rather than just headlines.

Maintaining a diverse portfolio across different sectors and asset types can mitigate the impact of pronounced market swings.

The evolving narrative surrounding tariffs—whether it becomes stricter, more lenient, or experiences delays—will greatly affect market confidence.

The Dubai stock market is facing declines today due to mounting concerns over a potential tariff proposal backed by Donald Trump. While this bill is yet to be enacted, the anticipated ramifications for global trade, corporate performance, and investor sentiment have led to widespread selling. Export-centric stocks, shifts in foreign investment, and uncertainty at a global level further amplify the ongoing market weaknesses.

Increasing tariffs imply a trend towards trade protectionism, historically linked to rising costs, diminished trade volumes, and heightened investor unease. Until greater clarity emerges regarding tariff realities and global economic signals, expect continued stock market volatility.

Disclaimer:

This article is intended for informational purposes only and does not serve as financial, investment, or trading advice. Markets can change rapidly, and investors are encouraged to consult licensed financial professionals before making investment decisions.

Winter Skin Care: 10 Hydrating Drinks That Give Natural Glass Skin Glow

Learn how simple winter drinks keep your skin hydrated reduce dryness and support a natural glass sk

10 Songs That Carry the Same Grit and Realness as Banda Kaam Ka by Chaar Diwari

From underground hip hop to introspective rap here are ten songs that carry the same gritty realisti

PPG and JAFZA Launch Major Tree-Planting Drive for Sustainability

PPG teams up with JAFZA to plant 500 native trees, enhancing green spaces, biodiversity, and air qua

Dubai Welcomes Russia’s Largest Plastic Surgery Team

Russia’s largest plastic surgery team launches a new hub at Fayy Health, bringing world-class aesthe

The Art of Negotiation

Negotiation is more than deal making. It is a life skill that shapes business success leadership dec

Hong Kong Dragon Boat Challenge 2026 Makes Global Debut in Dubai

Dubai successfully hosted the world’s first Hong Kong dragon boat races of 2026, blending sport, cul

Ghanem Launches Regulated Fractional Property Ownership in KSA

Ghanem introduces regulated fractional real estate ownership in Saudi Arabia under REGA Sandbox, ena

Winter Skin Care: 10 Hydrating Drinks That Give Natural Glass Skin Glow

Learn how simple winter drinks keep your skin hydrated reduce dryness and support a natural glass sk

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin