Post by : Sam Jeet Rahman

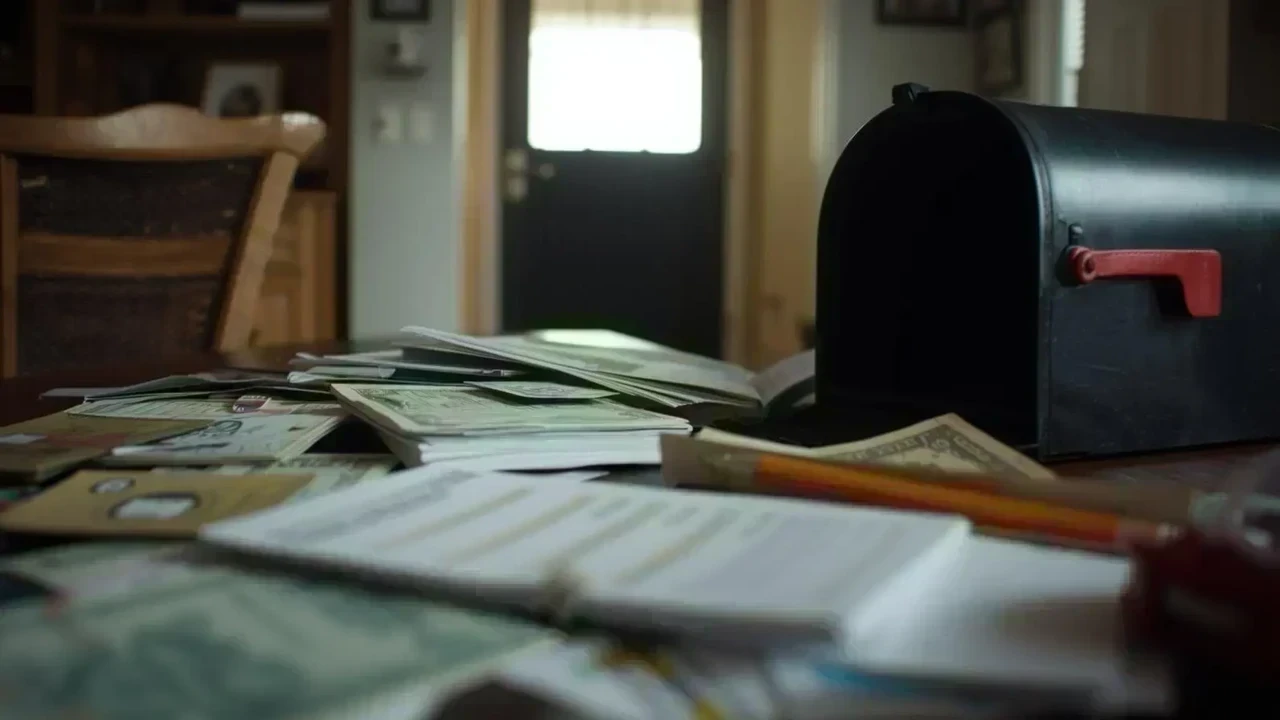

Middle-class families often work the hardest, budget the most carefully, and still feel constant financial pressure. Despite stable incomes, many households struggle with savings, rising expenses, and long-term security. The reason is rarely lack of effort. It is usually money management mistakes that quietly compound over time.

These mistakes are common, normalized, and often inherited through habits rather than conscious choices. This article explains the most frequent money management mistakes middle-class families make, why they happen, and how to fix them with practical, realistic changes.

Many families assume that a regular salary equals safety.

Job markets change quickly

Medical or family emergencies disrupt income

Inflation reduces real earning power

A stable income without buffers is fragile.

Build financial resilience, not just reliance on salary. This means emergency savings, insurance, and diversified income awareness.

Inflation slowly erodes purchasing power, yet many families plan expenses using outdated assumptions.

School fees rising faster than expected

Grocery bills increasing monthly

Healthcare costs jumping suddenly

Ignoring inflation creates budget shock.

Review household expenses every 6 months

Increase savings and investments gradually

Avoid locking finances into rigid structures

Planning for inflation is not pessimism—it is realism.

The most common budgeting error is saving after expenses.

Expenses expand to fill income

Savings become inconsistent

Emergencies wipe out progress

Leftover saving rarely builds wealth.

Treat savings like a fixed monthly expense. Automate it immediately after income is received.

Safety is important, but excessive focus on guaranteed returns creates long-term loss.

Returns often fail to beat inflation

Taxes reduce real gains

Long-term goals fall short

Money appears safe but grows weaker.

Separate money by purpose:

Short-term safety in low-risk instruments

Long-term goals in growth-oriented options

This balance protects both peace of mind and future value.

As income rises, expenses quietly rise too.

Bigger house with higher EMIs

Frequent dining and subscriptions

Costly gadgets upgraded regularly

Comfort becomes commitment.

Higher fixed expenses reduce flexibility. During income disruption, lifestyle inflation becomes financial stress.

Increase comfort slowly, but increase savings faster than lifestyle.

Many families rely on credit cards or loans during emergencies.

High-interest debt accumulates fast

Stress increases during crisis

Recovery takes years

Emergencies are predictable, even if timing isn’t.

Maintain an emergency fund covering at least 6 months of essential expenses, kept liquid and accessible.

Not all debt is equal, but many families treat it that way.

Paying minimum credit card dues

Ignoring high-interest personal loans

Delaying prepayment of costly EMIs

Interest quietly eats future income.

Always prioritize high-interest debt first, even if amounts seem small.

Insurance is often viewed as an unnecessary cost.

Medical inflation rises faster than income

Late insurance costs more

Inadequate coverage drains savings

Insurance is protection, not investment.

Adequate health insurance for the entire family

Life insurance aligned with responsibilities

Early planning saves money and stress.

Education and future planning are often handled emotionally.

No dedicated education fund

Borrowing later at high cost

Last-minute financial pressure

Children’s goals need long timelines.

Start small, early, and consistently. Time reduces pressure more than large contributions.

Financial habits are learned at home.

Children grow up financially dependent

Poor spending habits continue

Family stress repeats across generations

Money education is a family responsibility.

Involve children in budgeting discussions

Teach saving, not just spending

Explain value, not just price

This builds generational financial intelligence.

During market uncertainty, fear and greed drive decisions.

Switching investments frequently

Following tips from friends or social media

Panic selling during downturns

This destroys long-term growth.

A simple, consistent plan beats reactive decisions every time.

Many families don’t know where their money goes monthly.

Small leaks compound yearly

Overspending remains unnoticed

Savings stagnate

Awareness precedes control.

Track expenses for at least 90 days. Patterns become clear quickly.

Short-term comfort often overshadows long-term security.

Retirement planning

Healthcare costs later in life

Inflation impact over decades

The future becomes expensive when ignored early.

Plan for today, but fund tomorrow consistently.

Stress triggers impulsive decisions.

Shopping for relief

Eating out excessively

Unplanned upgrades

Emotional spending drains finances silently.

Pause before spending during stress. Delay decisions by 24 hours.

Hope is not a strategy.

Delays action

Normalizes financial pressure

Increases dependence on credit

Clarity replaces anxiety.

Small, consistent steps create control.

Save first, spend later

Reduce high-interest debt

Plan for inflation

Separate goals clearly

Review finances regularly

Progress does not require perfection—only consistency.

Middle-class families are not failing financially; they are operating within systems that demand better planning than ever before. Avoiding these common mistakes creates stability, confidence, and long-term freedom.

Money management is not about restriction—it is about intentional control.

This article is intended for general informational and educational purposes only and does not constitute financial, legal, or investment advice. Financial situations vary based on income, location, responsibilities, and personal goals. Readers are advised to consult a qualified financial professional before making significant financial decisions or changes.

Winter Skin Care: 10 Hydrating Drinks That Give Natural Glass Skin Glow

Learn how simple winter drinks keep your skin hydrated reduce dryness and support a natural glass sk

10 Songs That Carry the Same Grit and Realness as Banda Kaam Ka by Chaar Diwari

From underground hip hop to introspective rap here are ten songs that carry the same gritty realisti

PPG and JAFZA Launch Major Tree-Planting Drive for Sustainability

PPG teams up with JAFZA to plant 500 native trees, enhancing green spaces, biodiversity, and air qua

Dubai Welcomes Russia’s Largest Plastic Surgery Team

Russia’s largest plastic surgery team launches a new hub at Fayy Health, bringing world-class aesthe

The Art of Negotiation

Negotiation is more than deal making. It is a life skill that shapes business success leadership dec

Hong Kong Dragon Boat Challenge 2026 Makes Global Debut in Dubai

Dubai successfully hosted the world’s first Hong Kong dragon boat races of 2026, blending sport, cul

Ghanem Launches Regulated Fractional Property Ownership in KSA

Ghanem introduces regulated fractional real estate ownership in Saudi Arabia under REGA Sandbox, ena

Winter Skin Care: 10 Hydrating Drinks That Give Natural Glass Skin Glow

Learn how simple winter drinks keep your skin hydrated reduce dryness and support a natural glass sk

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin