Post by : Sam Jeet Rahman

Inflation affects everyone, from everyday shoppers to business owners. Prices for groceries, fuel, and services rise steadily, making it harder to maintain your current lifestyle. However, saving money during inflation doesn’t mean sacrificing comfort or habits. By making smarter financial decisions, you can protect your wealth, reduce unnecessary spending, and grow your savings—all while keeping your lifestyle intact.

Inflation is the rate at which the general price level of goods and services rises. When inflation is high:

Everyday items like food, gas, and utilities cost more.

Savings lose purchasing power over time.

Investments may yield lower real returns if they don’t outpace inflation.

Understanding inflation is the first step toward saving money strategically without cutting back on essentials.

Apps like Mint, YNAB (You Need a Budget), or PocketGuard track your income and expenses automatically. They help identify:

Subscriptions you don’t use

Overspending areas

Opportunities to save on recurring expenses

Tracking expenses doesn’t mean cutting lifestyle; it just shows where your money can work smarter for you.

Set up automatic transfers to your savings account or investment fund. Even small amounts saved consistently will grow over time, offsetting the impact of inflation without affecting daily habits.

Many credit cards, apps, and online platforms offer cashback, points, or rewards on regular purchases. Using these strategically can reduce your expenses subtly.

Purchasing non-perishable items in bulk or comparing prices online can save money without changing your preferred brands. Subscription services and loyalty programs can also offer hidden savings.

Plan major purchases around seasonal sales, clearance events, or digital coupons. This helps you maintain lifestyle quality while spending less.

Invest in energy-efficient appliances like LED lights, smart thermostats, or solar-powered devices. These reduce electricity bills without changing comfort levels at home.

Small adjustments like fixing leaks, installing low-flow showerheads, and using smart power strips can cut bills subtly without major lifestyle changes.

High-interest debt, such as credit card balances, grows faster than inflation. Prioritizing repayments frees up more money for savings in the long run.

If you have multiple debts, consolidating them at lower interest rates reduces monthly payments and stress, allowing you to maintain your current lifestyle.

Stocks and ETFs: Outperform inflation over the long term.

Real Estate: Provides steady income and potential appreciation.

Precious Metals: Protects wealth in volatile markets.

Even small, consistent investments can grow your wealth and offset inflation without cutting daily expenses.

Earn extra income through freelancing, digital gigs, or online businesses. Extra earnings enhance your lifestyle without requiring major sacrifices.

Focus spending on things that bring long-term value—like education, skill-building, or experiences—rather than fleeting items.

Even as income increases, resist unnecessary upgrades. This helps you save more money without feeling restricted.

Emergency Fund: Keep 3–6 months of expenses in a liquid account.

Insurance: Health, life, and property insurance protect you from unexpected costs.

Regular Review: Reassess your finances quarterly to adapt to inflation trends.

By future-proofing finances, you maintain lifestyle security and financial stability.

Saving money in an inflation era doesn’t mean cutting out comfort or luxury. By understanding inflation, tracking expenses, shopping smart, reducing debt, investing wisely, and making small but strategic adjustments, you can protect your wealth and lifestyle simultaneously. Smart, intentional financial decisions today ensure you can live comfortably while preparing for the uncertain future.

1. How can I save money during inflation without reducing my lifestyle?

Focus on smarter spending, energy efficiency, automated savings, and investing to grow wealth. This ensures your lifestyle remains unchanged while money works harder for you.

2. Are budgeting apps useful during inflation?

Yes. Budgeting apps help track expenses, identify waste, and optimize spending without affecting daily comforts.

3. Can cashback and reward programs really save money?

Absolutely. Using credit cards, apps, and loyalty programs strategically can reduce costs subtly on regular purchases.

4. Should I cut down on essentials to save money?

No. Focus on optimizing spending and energy use rather than cutting essentials or quality items.

5. What are the best investments to protect against inflation?

Stocks, ETFs, real estate, and precious metals generally outperform inflation over time and preserve wealth.

6. How does automating savings help?

Automatic transfers to savings or investments ensure consistent growth without conscious effort, offsetting inflation impact.

7. Can side hustles help during inflation?

Yes. Additional income streams supplement regular earnings, helping maintain lifestyle while saving for the future.

Magnus Carlsen Skips Chess World Cup 2025 Amid FIDE Dispute

World No. 1 Magnus Carlsen has opted out of the Chess World Cup 2025 due to conflicts with FIDE over

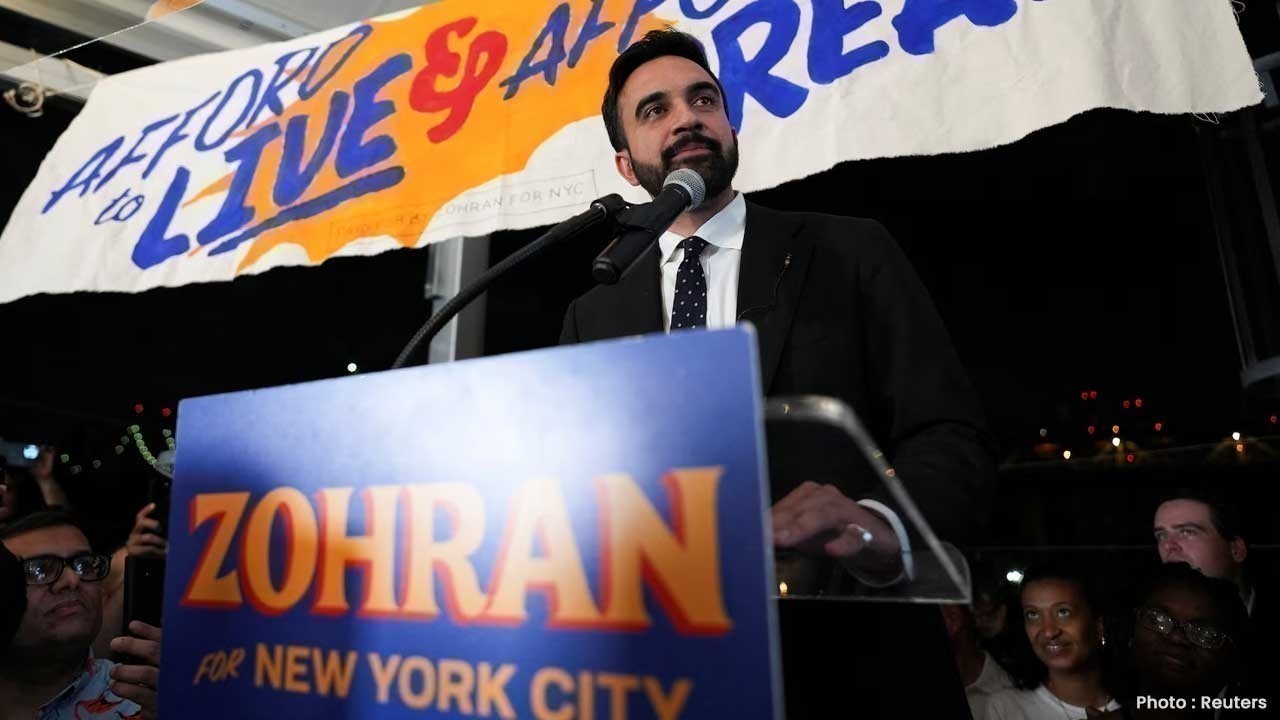

Zohran Mamdani Wins NYC Mayor Race Promises to End Islamophobia

Zohran Mamdani becomes New York City’s new mayor, pledging to end Islamophobia and empower immigrant

Virat Kohli at 37: The Icon Who Redefined Indian Cricket’s Mindset

Virat Kohli birthday, Kohli legacy, Indian cricket culture, Kohli fitness revolution, cricket news I

Teen Arrested for Damaging Priceless Artworks at Met Museum NYC

Teen arrested at New York’s Met Museum after damaging priceless artworks. Met Museum security ensure

Mac Allister, Diaz shine as Liverpool, Bayern, Arsenal stay perfect

Liverpool edge past Real Madrid, Bayern beat PSG, and Arsenal clinch a dominant win to maintain perf

Heart Surgeon Shares 5 Simple Daily Habits That May Help You Live Longer

A heart surgeon with 25 years of experience shares 5 daily habits for longer life, including exercis

Flights Halted at Washington Reagan Airport After Bomb Threat Scare

Washington Reagan Airport flights halted after bomb threat. All flights resumed safely as authoritie

UAE Life High Stress 3 Simple Ways Expats Can Manage Pressure

Expats in the UAE face daily pressure and burnout Learn 3 simple effective ways to manage stress fin

Smart Meal Prep in Dubai Save Money Stay Healthy

Plan smart eat fresh Discover how meal prepping in Dubai helps you save money eat healthy and enjoy

The Ultimate Guide to Dieting in Dubai Keto vs Vegan vs Mediterranean

Discover Dubai’s top diet trends Keto Vegan and Mediterranean Find which plan fits your lifestyle f

Stay Fit in Dubai 7 Fun Outdoor Workouts Without a Gym

Explore 7 fun ways to stay fit in Dubai from beach runs to desert hikes and skyline yoga No gym nee

Beyond Biryani: Mastering Portion Control in Dubai’s Melting Pot of Cuisines

Discover how to enjoy Dubai’s diverse cuisines wisely Learn simple portion control tips to stay heal

Fabien Marchand — The Infinite Brushstroke of Freedom

French artist Fabien Marchand explores freedom, color, and emotion through his evolving art — bridgi

Dubai’s Healthy Food Revolution 5 Global Wellness Trends Transforming the City

Discover how Dubai is embracing a global wellness wave with plant based diets organic food and smart

Start Your Day with Chia Seeds for Stronger Healthier Hair Naturally

Discover how morning chia seeds boost hair growth add shine and strengthen roots naturally with easy